For years, traditional finance folks saw Bitcoin as the wild child of the investing world. Volatile, unpredictable, and probably just a passing trend. Fast forward to now, and the world’s largest asset manager, BlackRock, is flipping the narrative. Their take? It might actually be too risky not to own some Bitcoin. Bitcoin ETF inflows for 2025 show growing trust in digital assets among traditional finance firms.

That’s right. BlackRock, which oversees more than $10 trillion in assets, is now calling Bitcoin a “strategic asset.” And it’s not just words, they’ve got skin in the game.

From Skepticism to Strategy

Robbie Mitchnick, head of digital assets at BlackRock, the world’s largest asset manager, made the point during his talk at Token2049. BlackRock didn’t always have warm feelings toward crypto. But like many institutions, the firm has slowly changed its tune. Why? Because the data is getting harder to ignore.

Bitcoin has outperformed just about everything over the past decade. It’s not tied to any central bank, it’s got a hard supply cap, and it’s become a global alternative for investors who don’t entirely trust fiat currencies.

BlackRock just suggested a 2% allocation to Bitcoin.

With $900 trillion in global assets, that’s an $18 TRILLION Bitcoin market cap.

Meaning each Bitcoin could be worth around $900K.

We’re not even close to the finish line, folks. This is just the beginning.  #BTCUSD

#BTCUSD

— w3ultra (@w3ultra) May 5, 2025

In a recent discussion, BlackRock executives made the case that Bitcoin isn’t just a speculative gamble anymore. It has characteristics that make it genuinely useful in a long-term portfolio. Specifically, they pointed to its low correlation with traditional assets like stocks and bonds, and its role as a potential hedge in a shifting macro environment.

Don’t Bet the Farm, But Maybe a Chicken

Of course, BlackRock isn’t saying you should go full degen and dump your life savings into Bitcoin. Their recommendation is a modest one: if you’re a curious investor, consider a 1 to 2 percent allocation. Small enough not to wreck your portfolio if things go south, but enough to give you some exposure if Bitcoin continues climbing.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in March 2025

That advice was included in a 2024 report and still holds true today. The firm is urging investors to think of Bitcoin less like a lottery ticket and more like a high-risk, high-reward tool for portfolio diversification.

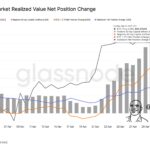

Bitcoin ETF Inflows for 2025: The $50 Billion Vote of Confidence

This isn’t just talk. BlackRock’s iShares Bitcoin Trust (IBIT), its spot Bitcoin ETF, has seen massive inflows. As of late April 2025, the fund holds over $51 billion worth of Bitcoin, making it one of the largest crypto investment vehicles in the world. That kind of money doesn’t flow unless institutions are taking this asset seriously.

And it’s not just BlackRock. Rival asset managers like Fidelity, Bitwise, and Ark Invest have also launched their own spot Bitcoin ETFs, all riding the same wave of institutional demand.

What Does This Mean?

BlackRock’s shift on Bitcoin is more than just a headline. It’s a signal that the crypto space is growing up. Sure, the volatility’s still there. And yes, there are plenty of risks. But for long-term investors, ignoring Bitcoin completely might no longer be the conservative choice. Instead, playing it safe could mean getting left behind.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- BlackRock now views Bitcoin as a strategic asset, citing its long-term performance and low correlation with traditional investments.

- The asset manager recommends a modest 1–2% Bitcoin allocation for curious investors seeking diversification without excessive risk.

- BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed $51 billion in assets, showing strong institutional interest in the crypto space.

- Bitcoin’s appeal lies in its fixed supply, independence from central banks, and rising status as a hedge in uncertain macro environments.

- BlackRock’s shift reflects a broader trend of traditional finance embracing Bitcoin as more than just a speculative play.

The post Too Risky Not to Own: BlackRock Backs Bitcoin as a Strategic Asset appeared first on 99Bitcoins.