Following a strong 2024 business performance, with $1.5 billion in revenue, Kraken released its latest report and other official company announcements. The Kraken Q1 2025 financial update revealed that the crypto platform generated $475 million in gross revenue, marking a 19% YoY growth in topline.

Despite a 7% revenue drop from the previous quarter due to a sagging market, Kraken netted $184.4 million in adjusted EBITDA. This is a 1% sequential increase, showcasing the company’s resilience amid stagnant conditions. Additionally, Kraken’s total exchange trading volume rose by 29% YoY.

The figures from the Kraken crypto exchange Q1 earnings report tell a clear story of a platform that isn’t just surviving market cycles, but building through them. Continue reading as we explore what this means for the cryptocurrency trading platform amidst the NinjaTrader and Kraken merger.

Acquisition of NinjaTrader – A Landmark Move in TradFi & Crypto Integration

Kraken has already confirmed its acquisition of NinjaTrader, a leading US derivatives trading platform. Soon, Kraken’s users can access traditional derivatives markets, and NinjaTrader clients can open multi-asset crypto trading orders without leaving their platforms.

The Kraken Ninjatrader acquisition is the largest in the crypto exchange’s history and signals a shift towards a more holistic trading experience for retail investors. The partnership may drive more TradFi companies to integrate institutional crypto trading into their future offerings.

Additionally, Kraken aims to expand its offerings in other asset classes, such as stocks, prediction markets, and options, to remain competitive among the top crypto derivatives platforms. As the exchange extends its reach beyond crypto, it becomes clear that Kraken’s partnership with NinjaTrader comes as a strategic fit.

Visit Kraken

Product Innovations for Kraken’s Clients

Innovation remains a key theme with the crypto exchange, shown in the Kraken revenue 2025 highlights. Let’s break down these updates below:

- Kraken Pay: Allows users to make instant global crypto and fiat payments in over 300 currencies, simplifying cross-border transfers for individuals and businesses.

- New Kraken App: Redesigned mobile app focusing on intuitive wealth-building with multi-asset capabilities.

- OTC Tools in Kraken Pro App: Large-volume traders can now execute OTC (over-the-counter) orders directly within the Kraken Pro app, enhancing privacy and execution speeds.

While many of these innovations catered to retail crypto users, institutional clients were not left behind. Kraken rolled out its API fix for crypto futures, offering faster transactions and more reliable connectivity for high-value clients and partners. This update directly contributed to a 250% increase in monthly Kraken derivatives trading volume in Q1 2025 alone.

Leading with Transparency – Quarterly Proof of Reserves

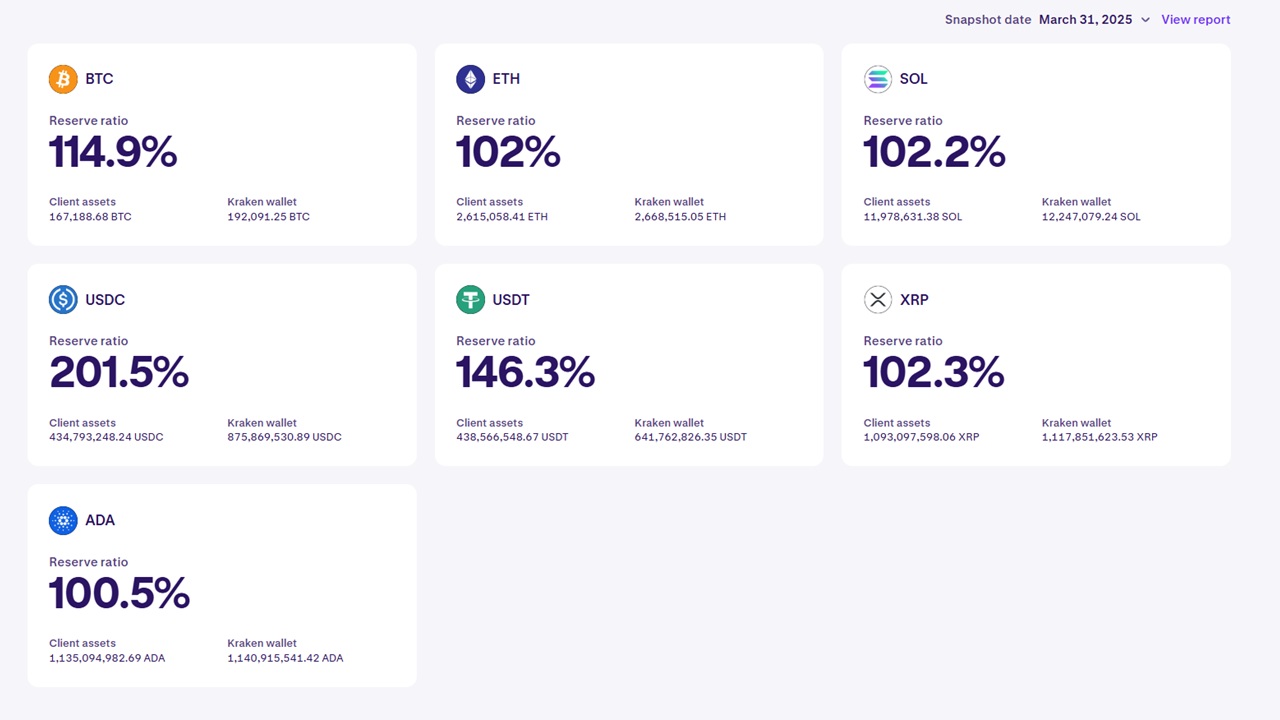

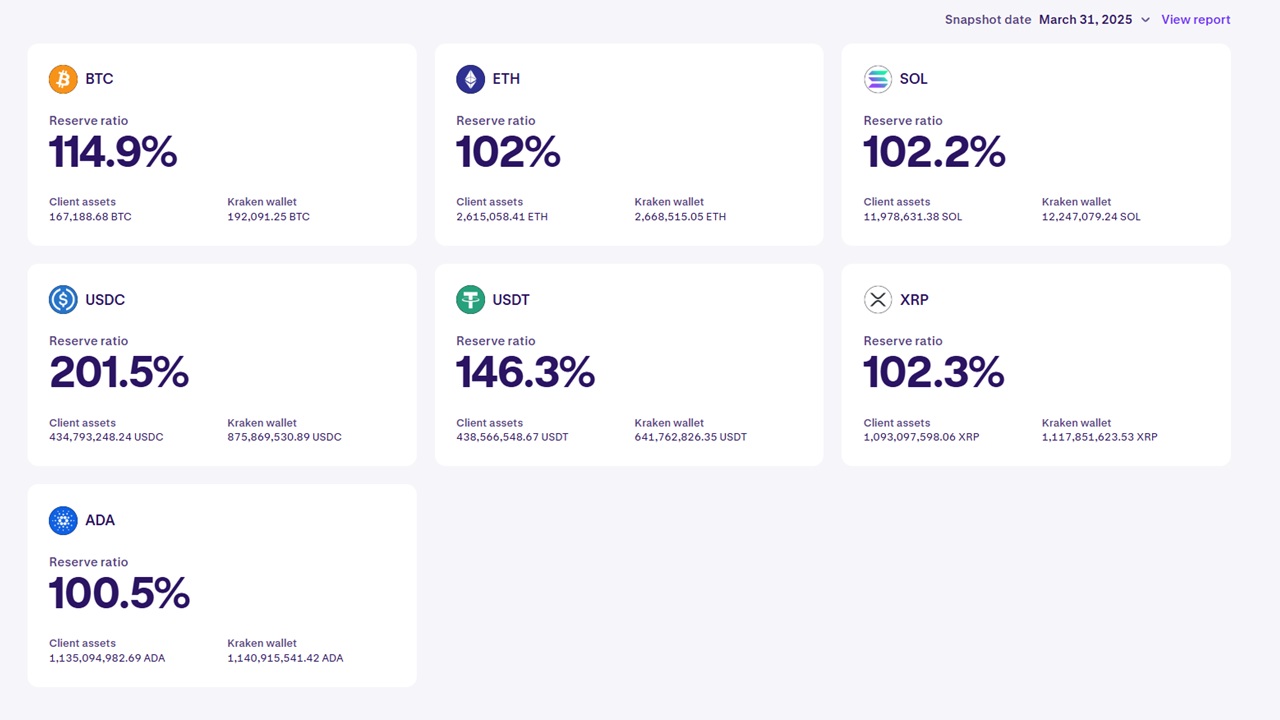

Known as one of the most trusted crypto exchanges, Kraken prioritizes transparency for users’ crypto holdings. On March 31, 2025, it completed another Proof of Reserves audit, allowing users to verify that their assets are fully backed.

The Q1 2025 Kraken Proof of Reserves report uses a Merkle tree cryptographic technique, ensuring that every user’s crypto balance is accounted for without revealing personal information. Unlike some platforms that require just a one-time attestation, Kraken raises the bar by offering investors the tools to check their holdings through a public audit.

Kraken pioneered regulated Proof of Reserves before other platforms followed suit, cementing the global crypto exchange’s market credibility. The quarterly reserves audits align with Kraken’s commitment to operating as a trusted custodial platform. With Kraken ensuring every client has peace of mind knowing their holdings are secured, users can focus on growing their investment portfolios.

Strategic Vision – Kraken’s Multi-Asset Future

Kraken’s long-term goal of becoming the go-to platform for secure and reliable multi-asset trading is quickly taking shape. With the addition of NinjaTrader, Kraken now has the infrastructure to support not only crypto and derivatives but eventually other traditional instruments to help diversify returns.

More varied asset offerings mean professional traders and institutions can operate in a single consolidated platform. Instead of managing multiple accounts with varying trading instruments across platforms, they can soon rely on Kraken to invest in traditional assets and cryptocurrencies with the most potential.

Furthermore, Kraken’s future trading experience is supported by strong regulatory compliance. With licenses across key markets, Kraken can scale into crypto-limited regions while maintaining its seal of user safety. Its global licenses will also help NinjaTrader expand internationally, paving new revenue streams and broadening the derivatives platform’s institutional appeal.

Final Thoughts – Kraken Sets the Standard for 2025

If the Kraken Q1 2025 financial update is any indication, the exchange is on track to deliver another exceptional performance this year. With nearly half a billion dollars in quarterly revenue and solid adjusted EBITDA, Kraken continues to prove that its business model can withstand changing market conditions.

What truly sets Kraken apart is its commitment to trust and transparency. In an environment where non-custodial options are becoming increasingly popular and custodial solvency is constantly questioned, the platform takes a proactive approach in verifying user crypto holdings.

For Kraken, the path forward includes broader market accessibility, improved trading features, and expansion into various asset classes. Follow the exchange’s news and media channels to stay updated with Kraken’s latest developments.

Visit Kraken

References:

- Kraken Completes Acquisition of NinjaTrader (Business Wire)

- Kraken Q1 2025 financial update: Strength through market cycles (Kraken Blog)

- Proof Of Reserves | Full Reserves (Kraken)

The post Kraken Reports $472M in Q1 Revenue and Completes NinjaTrader Acquisition to Expand Multi-Asset Trading Vision appeared first on 99Bitcoins.