Key Takeaways

- Tech giants like Meta, Amazon, Google, and Microsoft may issue stablecoins if they comply with the revised GENIUS Act.

- The GENIUS Act mandates strict safeguards and gives the Treasury Department authority to suspend issuer registrations.

Share this article

Tech giants Meta, Amazon, Google, and Microsoft may still be able to issue stablecoins under a proposed bipartisan amendment to the GENIUS Act—but only if they comply with a rigorous set of safeguards, according to the bill language reviewed by journalist Eleanor Terrett.

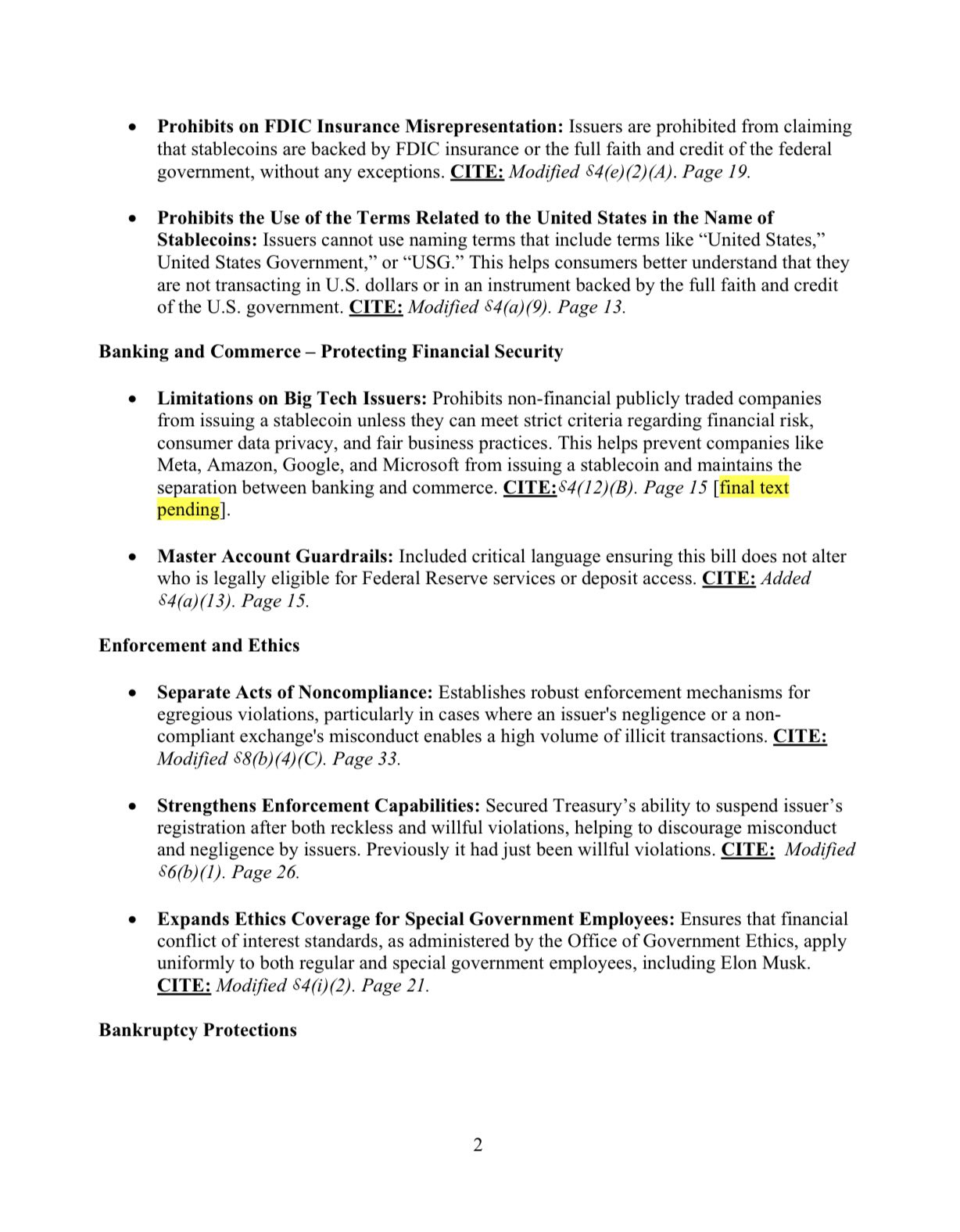

The amendment would allow these companies to launch stablecoins only if they implement robust financial risk controls, strong consumer data privacy protections, and fair business practices before entering the stablecoin market.

The provision is part of a broader section entitled Banking and Commerce – Protecting Financial Security, which also includes “Master Account Guardrails” meant to ensure that the amendment does not alter current eligibility for Fed access.

The revised text also strengthens consumer protections, banning any suggestion that stablecoins are backed by FDIC insurance or by the full faith and credit of the US government. In addition, stablecoin issuers would be prohibited from using government-associated terms like “United States” or “USG” in the naming of their tokens.

Under the revised framework, the Treasury Department receives expanded authority to suspend issuer registrations for both willful and reckless violations, with each instance of noncompliance potentially treated as a separate offense.

The GENIUS Act, short for the Guiding and Ensuring National Interest in Unified Stablecoins Act, failed a Senate vote on May 8 after Democrats withdrew support over concerns about potential conflicts of interest related to President Donald Trump and Trump-affiliated stablecoin issuer World Liberty Financial (WLFI).

Bipartisan negotiations have resumed to modify the bill’s language, with Senate leadership considering steps to restart formal consideration before the Memorial Day recess, including reopening the amendment process.

Share this article