Share this article

If you’re an asset manager trying to manage multiple clients’ investments and struggling to launch your own pro-grade crypto investment management platform, the idea of coding one from scratch—or coughing up millions—can feel like a nonstarter.

Now Finestel comes in. With over $50 billion in trading volume and 100 million+ replicated orders as of May 2025, Finestel is the #1 non-custodial trading automation software provider for money managers, wealth managers, and any crypto (and soon forex) investment management businesses.

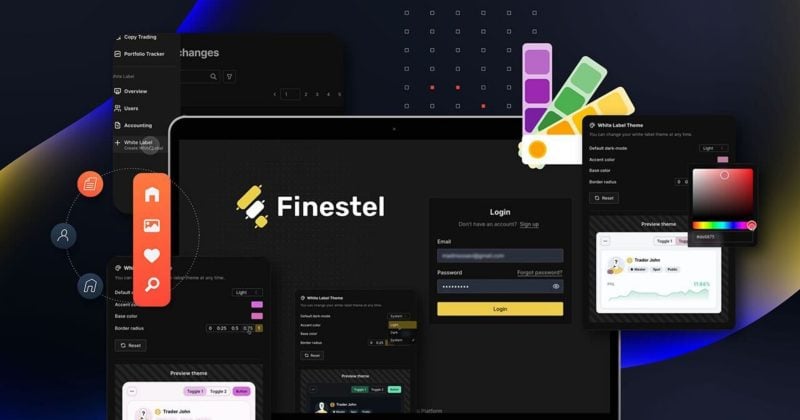

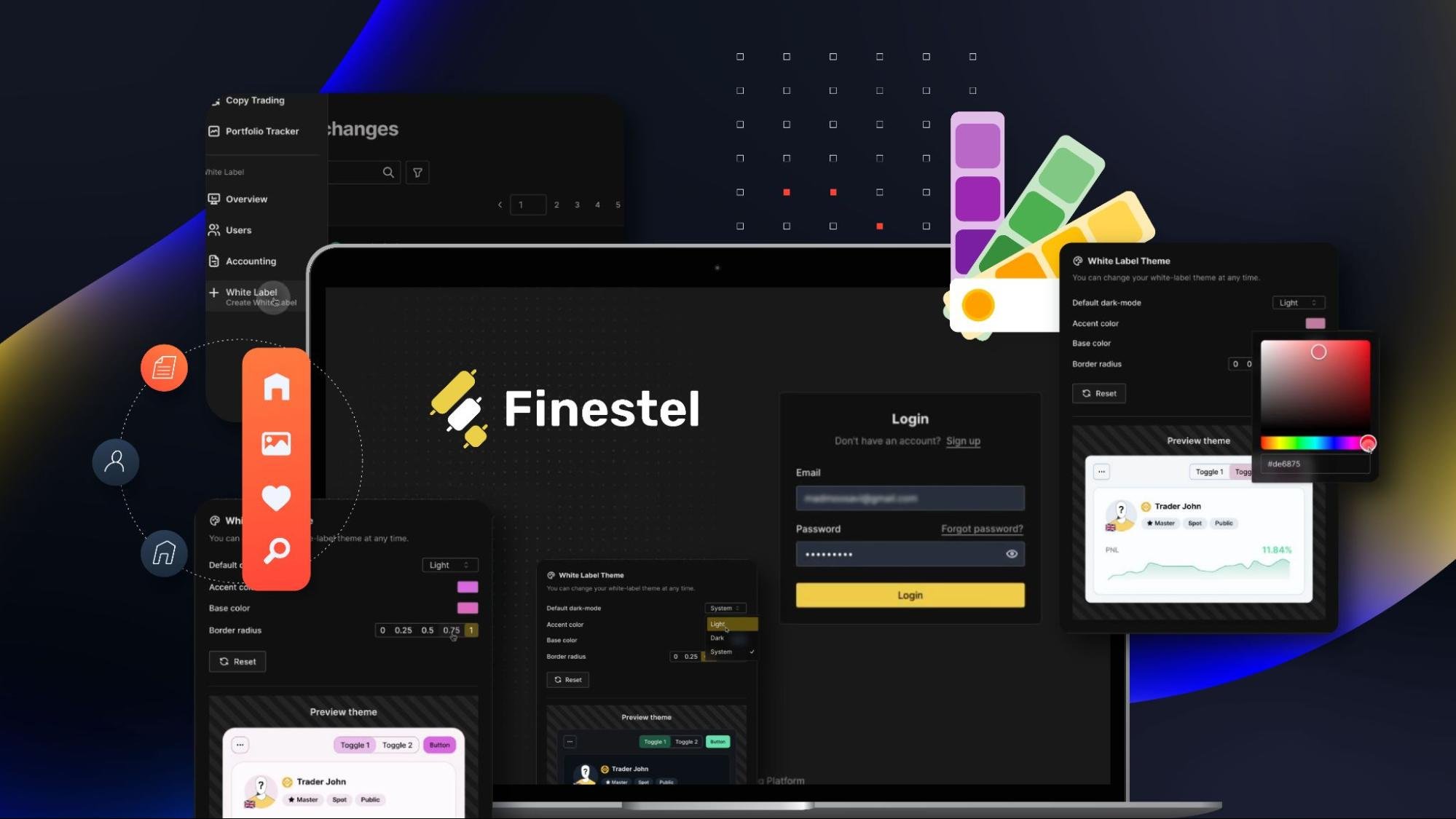

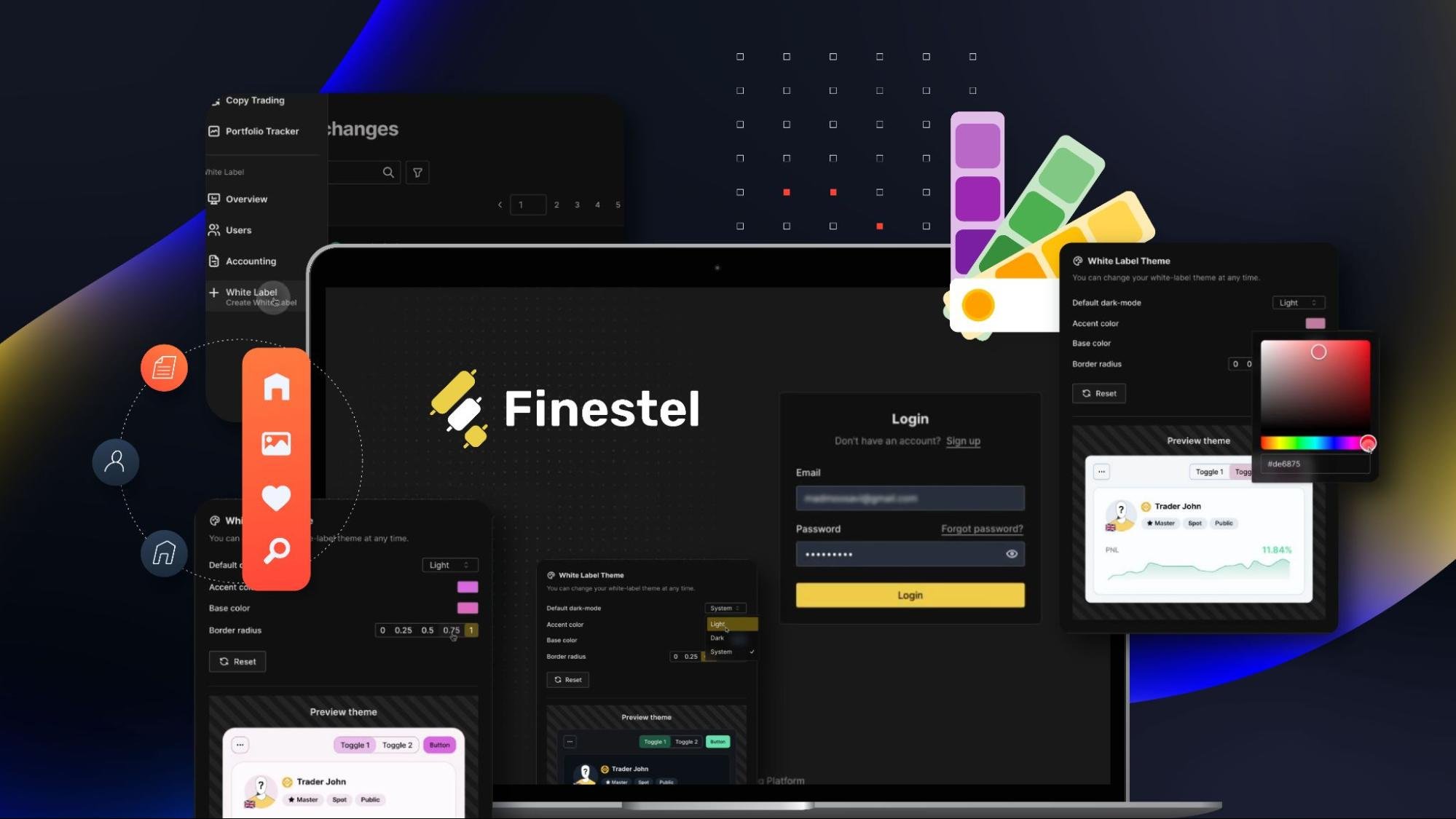

Finestel’s white-label asset management solution lets asset managers launch their own branded automated trading hubs and manage multiple exchange accounts effortlessly. Forex integration will also broaden their scope.

Two primary software suites of Finestel’s white label

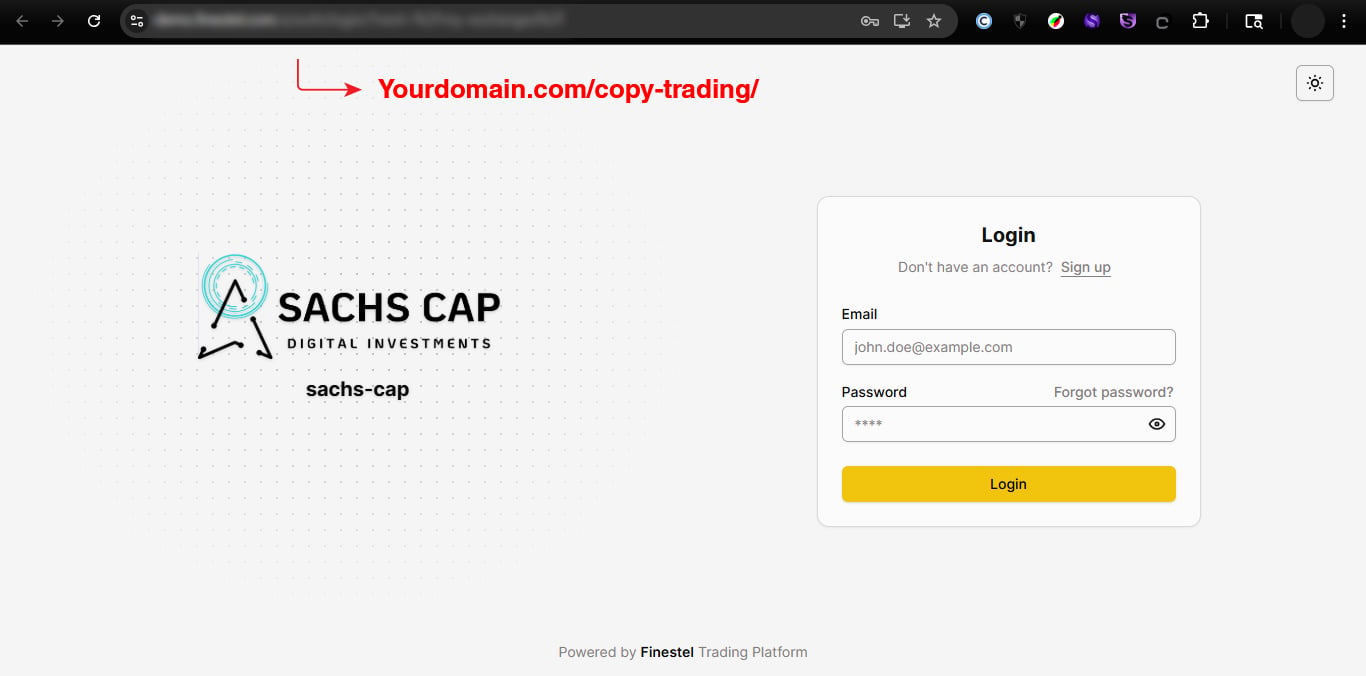

Imagine renting a fully built, high-end auto-trading & investment platform, slapping your logo on it, and calling it yours; that’s white-labeling in a nutshell.

Finestel’s asset management software suite of tools includes 2 main categories:

-

Portfolio & order tracking, order & trade management & order execution engines

Track portfolios and automate trade execution seamlessly on Binance, Bybit, KuCoin, OKX, and Gate for spot and futures, and soon Coinbase, with secure APIs ensuring non-custodial asset safety.

-

Copy Trading Bot: Mirrors strategies across exchange accounts in a few milliseconds, with precision.

-

Signal Bot: Executes trades from any user-chosen source—TradingView, scripts, social media, on-chain data, etc.

-

Telegram Signal Bot: Uses AI to process trading signals, turning alerts into trades.

-

TradingView Bot: Automates chart strategies execution via webhook.

-

Portfolio Tracker: Tracks portfolios and assets in real-time and provides detailed reports on each and total accounts.

-

Client management, billing, sales & marketing dashboards, and infrastructures

Expand your business and client management with intuitive admin dashboards and growth-focused tools.

-

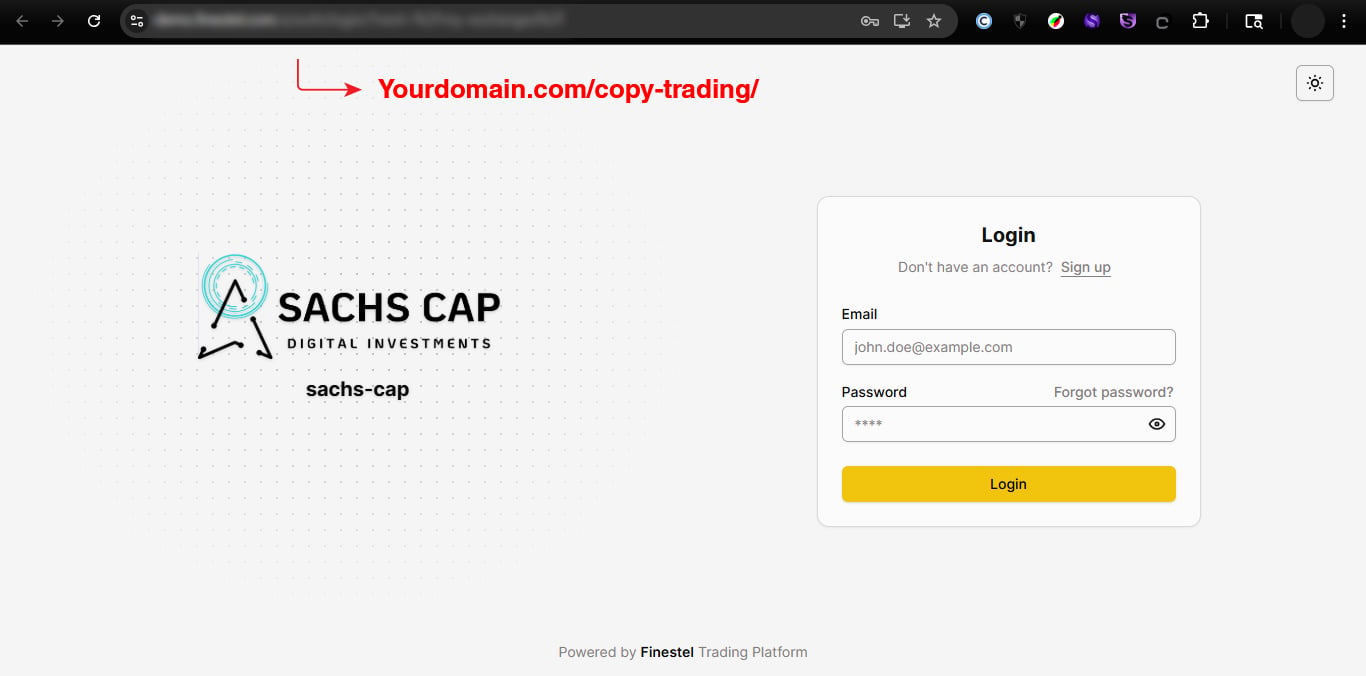

Custom branding: Add your logo, colors, domain, and identity to create a platform that’s 100% yours, from mobile app to vibrant web portals.

-

Client dashboard: Manage your clients with accounting, reporting, and order management in one hub. An asset manager said, “It’s like a full admin team in one tool.”

-

Billing system: Automated billing, subscription plans, and performance fee systems cut admin time to near zero.

-

Marketing tools: Grow your client base with referral systems and MLM software for commission-based expansion.

-

Branded mobile apps: Launch your custom app on App Store and Google Play for client access.

-

Custom development: Need something unique? Finestel can build any custom requested feature.

Based on reviews on Trustpilot (4.7/5 rating), asset managers trust Finestel to scale their trading and money management businesses, praising it as a comprehensive, all-in-one solution for non-custodial asset management.

Some asset managers mentioned Finestel better supports forex integration, but the good news: MT5 and MT4 integration are coming soon.

Private strategy marketplace, an enterprise complimentary service

Finestel’s Private Strategy Marketplace links top traders of the white labeled funds with other platform owners, practically providing them with more AUM. Traders share proven strategies, and owners add them to their platforms, giving clients more options and boosting revenue through fees. It’s a profit-sharing win-win strategy to enhance white-label offerings and traders’ income.

Success stories: Verified profits from real users

The numbers below come as real examples from asset managers running their private AM business on Finestel’s infrastructure. These case studies showcase the platform’s ability to drive revenue and scale operations:

-

PeakPulse (Thailand): $100K-$200K AUM, $110K revenue, $90K margin (since July 2023).

-

TitanFlow (UAE): $3M-$5M AUM, $240K revenue, $231K margin (since Apr 2024).

-

QuantumRise (Global): $15M-$20M AUM, $300K revenue, $297K margin (since Jan 2025).

Getting started

-

Sign up at Finestel.com

-

Connect master exchange accounts (Binance, Bybit, KuCoin, OKX, Gate.io, Coinbase) via APIs.

-

Create your white-label platform.

-

Customize your platform

-

Invite and onboard your clients

-

Add optional bots: Signal, Telegram, or TradingView.

*Finestel’s 24/7 support team, highlighted on Trustpilot and their website, is a key value of their white-label solution.

Final verdict

For asset managers hunting for a solution to elevate their careers, Finestel is the answer they’ve been searching for. Its white-label SaaS, paired with automation tools, delivers a powerhouse for managing multiple exchange accounts.

Platforms this comprehensive and user-focused are rare gems in the crypto space. When we tested Finestel, it truly blew us away with its client-ready features and seamless execution.

Share this article