Tron pulled ahead of rivals in blockchain earnings last year, generating $3.6 billion, a figure that highlights how stablecoin activity can outweigh sheer market value when it comes to network income. According to Token Terminal, that tally places Tron well above larger rivals on pure revenue terms.

Tron Tops Revenue Charts

Tron’s lead stems largely from stablecoin settlements, with reports showing about 51% of circulating Tether USDT has been issued on the Tron network.

Ethereum, by comparison, recorded roughly $1 billion in revenue over the same period, even as ETH’s market cap was around $540 billion — more than 16x the TRX market cap, which sits just north of $32 billion. The gap between market value and on-chain revenue is stark.

Revenues Down In September: VanEck

Network revenues across blockchains fell 16% month-over-month in September, according to a VanEck report. Traders had fewer reasons to pay for priority processing because markets calmed, and that drop in activity hit fee income.

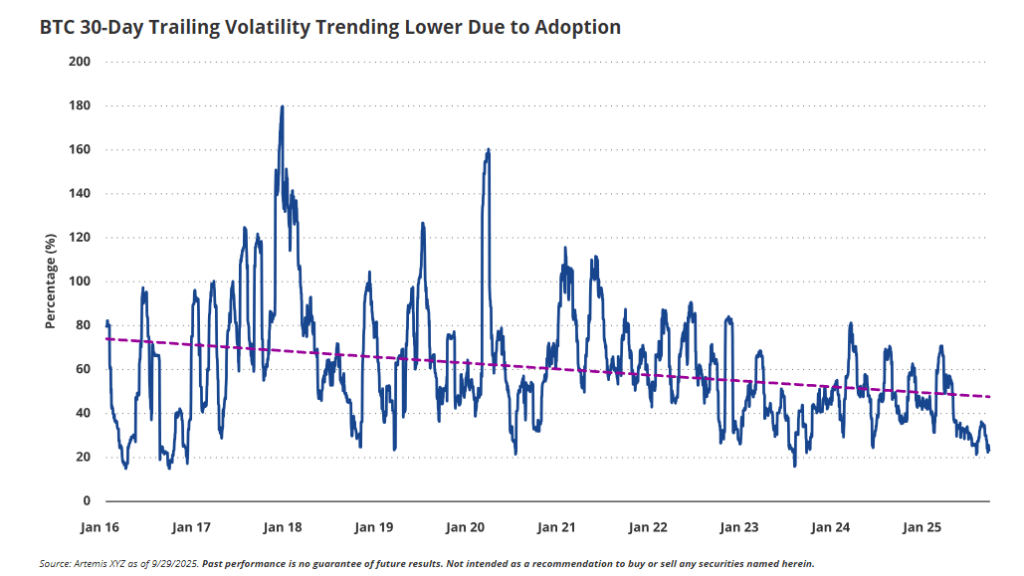

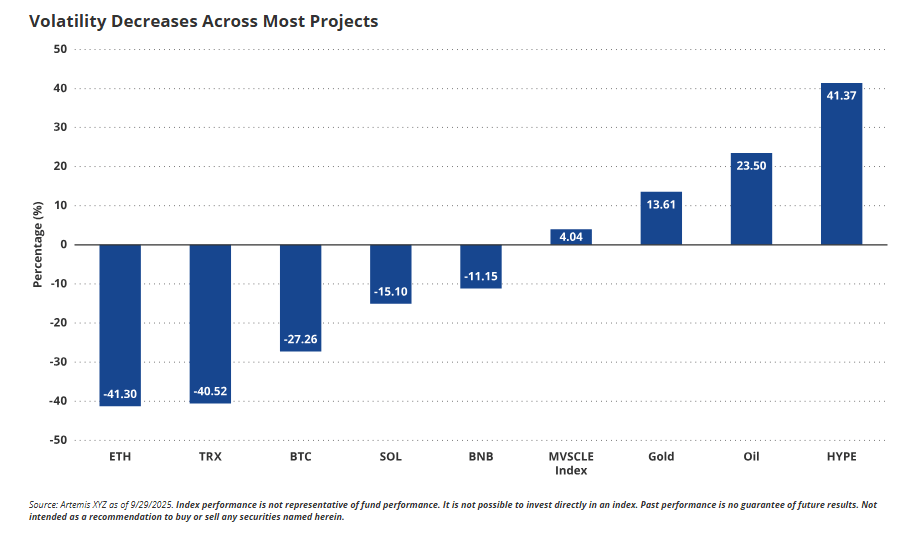

Volatility measures fell sharply: Ether volatility dropped 40%, SOL slid 16%, and Bitcoin volatility fell 26% in that month. Lower price swings mean fewer quick trades and fewer high-fee transactions.

Fees Fell As Volatility Cooled

Ethereum network revenue declined by 6% in September. Solana’s receipts slipped by 11%. Tron’s fees plunged 37%, but that figure was driven partly by a governance change: a proposal reduced gas charges by over 50% in August, and those lower costs showed up in September’s numbers. In short, both market quiet and policy moves combined to trim what users paid to move assets on chain.

Stablecoins And Settlement Activity Mattered More Than Hype

The stablecoin market also continued to grow, with data from RWA.XYZ showing the total stablecoin market cap crossed $290 billion in October 2025.

That expanding pool of tokenized dollar balances tends to favor blockchains with cheap, fast transfers. For Tron, heavy stablecoin issuance has translated into steady transaction volumes and a different kind of economic engine than networks that rely more on DeFi or speculative trading.

Stablecoins Drive Transaction Flows

Stablecoins let value move across borders with near-instant settlement and low fees. They trade round the clock and do not require a bank account, which helps explain why on-chain volumes can diverge from pure token market caps.

Reports have disclosed that this utility-based demand is a major reason Tron outpaced others in revenue, even if its native token remains far smaller by market value.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.