Ethereum

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

0.45%

Ethereum

ETH

Price

$4,510.74

0.45% /24h

Volume in 24h

$35.86B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

experienced strong ETF inflows this week, even as the ETH price USD pulled back from recent highs. The market now faces a key technical test near $4,400 and possibly the $4,250–$4,300 zone, where buyers have shown early signs of defense. Bulls are eyeing new highs — but is $5,000 within reach for ETH or an impossible ceiling?

$ETH is nowhere near a top.

Since 2017, every ETH top has happened when it has touched this trendline.

Right now, it's sitting around $9K which is 100% rally from here.

Don't be a panic seller now. pic.twitter.com/gpUZROf0Fz

— ZYN (@Zynweb3) October 8, 2025

On October 7, Ethereum exchange-traded funds (ETFs) recorded a combined inflow of approximately $420.9 million, with BlackRock contributing $437.5 million — the largest single-day addition among all issuers.

(Source: Sosovalue)

(Source: Sosovalue)

This marks one of the strongest daily accumulation events for ETH since ETF trading began, signaling continued institutional demand despite short-term market volatility. However, price action diverged from the inflow data, as the ETH price USD faced rejection from the $4,750–$4,800 resistance range, leading to a moderate retracement.

EXPLORE: 15+ Upcoming Coinbase Listings to Watch in 2025

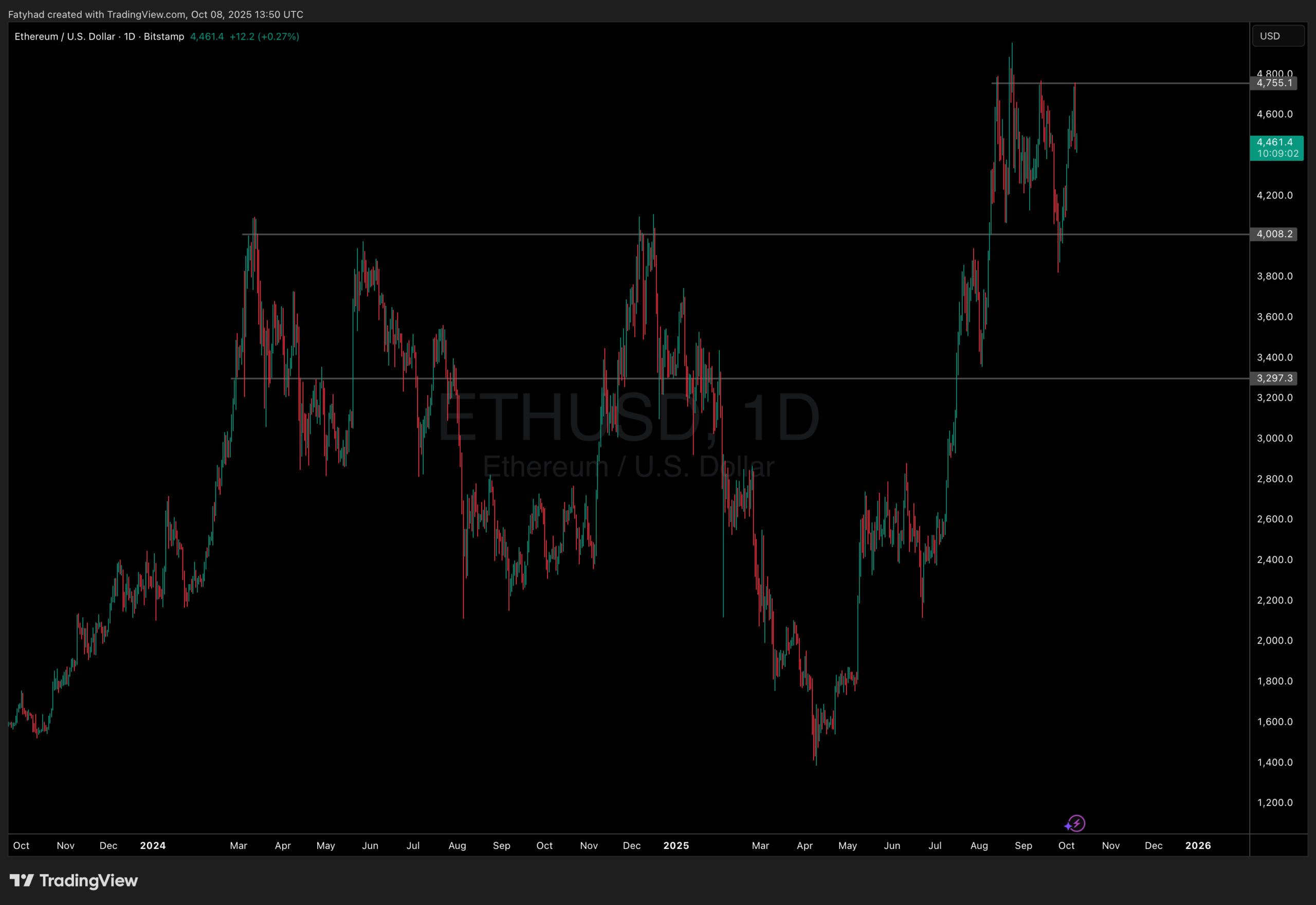

Ethereum Faces Short-Term Pressure After Rejection at $4,750, Support Near $4,400

Ethereum’s recent decline aligns with a 6.5% pullback from the local top, following a bearish divergence on the four-hour chart. The token fell below $4,500, finding temporary support around $4,400, a level that has acted as a pivot in previous trading sessions.

ETH now trades near $4,461. Defending this level is crucial, or the next possible steps are the $4,250-4,200 support area, which aligns with strong bid zones observed. A sustained hold above this range could confirm a short-term reversal pattern and potentially open the way for another test of the $4,750–$4,800 resistance.

Failure to maintain this support, however, may trigger a deeper correction toward $4,100–$4,000, where significant order blocks and historical demand exist on the daily timeframe.

(Source: Coingecko)

(Source: Coingecko)

The recent ETH retracement coincided with Bitcoin’s dip below $121,000, while

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

0.39%

BNB

BNB

Price

$1,320.32

0.39% /24h

Volume in 24h

$6.82B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

continued its upward momentum (with a recent ATH), drawing short-term market focus toward the BSC ecosystem as traders rotated capital across large-cap altcoins.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

ETH USD Price: Long-Term Fundamentals Remain Positive

Despite near-term weakness, on-chain indicators continue to support a constructive long-term outlook for Ethereum. Data from CryptoQuant shows that total exchange reserves have declined to approximately 16.1 million ETH, representing a 25% reduction since 2022. This consistent downtrend in exchange-held supply suggests that investors are moving coins off centralized platforms and into staking contracts, self-custody wallets, and institutional-grade custodians.

Such behavior typically signals reduced short-term selling pressure, as coins held outside exchanges are less likely to be used for immediate liquidation. The rise of liquid staking solutions such as Lido and Rocket Pool has also contributed to this dynamic, with staked ETH now accounting for a steadily increasing share of circulating supply.

Ethereum’s short-term outlook hinges on whether buyers can defend the $4,400 support area. ETF inflows remain a key bullish factor, but technical momentum has weakened in the near term. A strong rebound from current levels could confirm a continuation pattern toward $4,800–$5,000, while a breakdown would shift the focus toward $4,250 and possibly the $4,000 region.

EXPLORE: The Best Crypto Presales to Buy in October 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Ethereum saw $420.9M in ETF inflows on October 7, led by BlackRock, signaling robust institutional demand despite short-term price pullback.

- ETH price USD must defend $4,400 to avoid deeper corrections toward $4,250–$4,000; holding this level could spark a rebound toward $4,800–$5,000.

The post Is This It For Ethereum Bulls? Analysts Call ETH Price USD Top Amid Last Shot At $5K appeared first on 99Bitcoins.