Join Our Telegram channel to stay up to date on breaking news coverage

Strive urged MSCI to rethink a proposal to remove Bitcoin treasury firms from its indexes, warning that it would reduce investors’ access to ”the fastest-growing part of the global economy.”

Strive was responding to MSCI’s decision to consider excluding companies with more than 50% of their assets in crypto from benchmark eligibility. A decision is due on Jan. 15.

Strive, the 14th-largest listed BTC treasury firm, said in a letter to CEO Henry Fernandez that the threshold is also “unworkable,” arguing Bitcoin volatility would constantly push firms above and below the limit.

MSCI had said many investors view digital-asset-treasury firms more like funds than operating businesses, which would make them ineligible for inclusion in MSCI’s equity indexes.

The letter comes as analysts warn that the removal of companies such as Strategy, Metaplanet, and others from stock indexes will be a major blow to the crypto industry.

JPMorgan said Strategy’s removal could trigger up to $2.8 billion of outflows for the corporate Bitcoin buyer’s stock, with up to $12 billion at risk if other index providers follow MSCI’s lead.

Large Bitcoin Companies Are Playing A Major Part In The AI Boom

Strive CEO Matt Cole rejected MSCI’s view that large crypto treasury firms represent investment funds, and pointed to how Bitcoin miners, which often have large amounts of BTC on their balance sheets, are helping facilitate the AI boom with their surplus energy and infrastructure.

— Matt Cole (@ColeMacro) December 5, 2025

“Some of the companies with the largest Bitcoin holdings are miners who are becoming important AI infrastructure providers,” Cole said.

“All these miners are rapidly diversifying their data centers to provide power and infrastructure for AI computing,” he added. “But even as AI revenue comes in, their Bitcoin will remain, and your exclusion would too, curtailing client participation in the fastest-growing part of the global economy.”

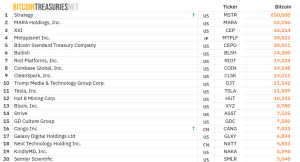

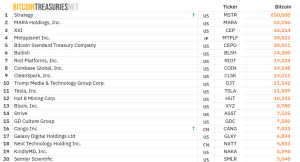

Top 20 BTC DATs (Source: Bitcoin Treasuries)

Cole also said that several Bitcoin miners have recently become “vendors of choice for tech giants’ computing needs, and that these companies are “ideally positioned” to meet the rising energy demand from AI firms.

BTC Structured Finance Is Growing

Cole also said that the removal of crypto treasury firms would cut off companies that offer investors a similar product to a variety of structured notes linked to Bitcoin’s returns that are currently offered by traditional finance giants such as JPMorgan, Morgan Stanley, and Goldman Sachs.

“Bitcoin structured finance is as real a business for us as it is for JPMorgan,” he said. “It would be asymmetric for us to compete against traditional financiers weighed down by a higher cost of capital from passive index providers’ penalties on the very Bitcoin enabling our offerings.”

`Unworkable’ 50% Threshold

Cole elaborated on his contention that MSCI’s 50% threshold is “unworkable in practice.”

“Tying index inclusion to a numeric threshold for famously volatile assets could cause more frequent turnover in funds benchmarked to MSCI’s products,” he wrote.

That, according to Cole, would raise the management costs and increase the risk of tracking errors as companies “flicker in and out of funds in proportion to their holdings’ volatility.”

In addition to the increased management and tracking errors, Strive’s CEO said that it will also be difficult to measure when a company’s holdings reach 50%.

“There are an increasing variety of instruments by which companies gain that exposure, many complex,” the CEO said.

“If a company holds Bitcoin structured products like JPMorgan’s or Strategy’s, does that count toward the 50%?” he asked. “Would it vary depending on the product, or would instruments beyond spot holdings offer ready ways of avoiding MSCI’s rule?”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage