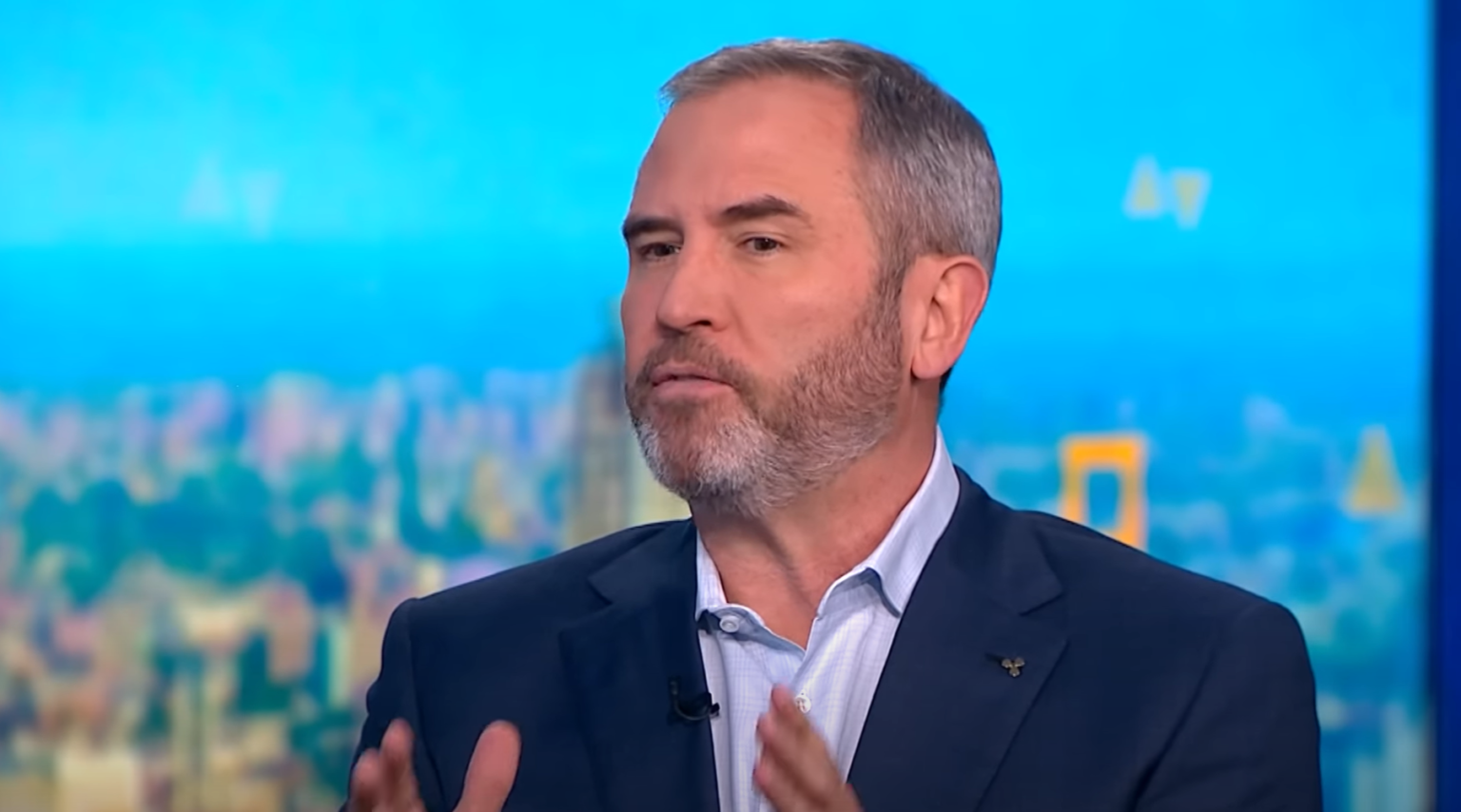

Ripple CEO Brad Garlinghouse confirmed in an interview with FOX Business that financial institutions, particularly banks, are increasing their engagement with Ripple and XRP following the US Securities and Exchange Commission’s (SEC) decision to end its investigation into the company. The development marks a significant turning point for Ripple and potentially the broader digital asset sector in the United States.

Ripple CEO: US Market Reawakens

Garlinghouse, reflecting on Ripple’s multi-year legal battle with the SEC, described the conclusion as an industry-wide win. “Ripple is really amongst the very first crypto companies to get sued by the SEC. We said then, when it started, that the SEC was going to be on the wrong side of the law as well as on the wrong side of history. It took longer than we would have liked… more than $150 million of legal bills, but we’re thrilled with the ultimate outcome. It allows us to really unlock the US market,” Garlinghouse stated.

Ripple, which has traditionally focused on cross-border payments, faced significant headwinds in the US market during the regulatory uncertainty. According to Garlinghouse, about 95% of Ripple’s current customer base consists of non-US financial institutions, including global giants like HSBC and BBVA. However, the conclusion of the SEC investigation is now prompting a noticeable shift in domestic engagement.

“In the six weeks after President Trump was elected, we signed more deals in the United States than we had in the previous six months. These are very innovative technologies. I think they’re going to play out over 10, even 20 years in terms of how they integrate and rewire the financial infrastructure of the United States. That’s across payments, that’s across even the settlement of maybe real estate transactions, securities transactions. […] I think people are underestimating how big that change is,” Garlinghouse disclosed.

The increased interest follows two major executive orders signed by President Trump as part of his pro-crypto agenda. These include initiatives aimed at “strengthening American leadership in digital financial technology” and establishing a “Strategic Bitcoin Reserve and US digital asset stockpile”. Speaking at the Digital Asset Summit in New York City last week, President Trump told attendees, “You will unleash an explosion of economic growth, and with the dollar-backed stablecoins, you’ll help expand the dominance of the US dollar.”

Garlinghouse called the shift in sentiment a profound “unlock” for US financial institutions. He remarked, “Banks that were really hesitant and nervous about touching crypto technologies or even helping their customers, those banks and those financial institutions are leaning in now, and that’s a big deal—not just for Ripple, but for the whole industry.”

The conversation also turned toward the ongoing regulatory framework discussions in Washington. Garlinghouse praised the efforts of lawmakers such as Senator Cynthia Lummis and Congressman French Hill, who are leading initiatives to clarify how digital assets are classified and regulated under US law. “It can’t just be executive orders. It needs to be codified with legislative efforts by Congress,” he stated, referencing progress on both a stablecoin bill and a market structure bill that could provide the clarity the industry has long sought.

Garlinghouse reiterated that XRP’s legal status has already received validation from the federal judiciary: “XRP was deemed to be a commodity or not a security by a federal judge, which is the opposite of what the SEC had said.” This ruling, coupled with pending legislation, is expected to strengthen Ripple’s position both domestically and internationally.

With trillions of dollars still flowing through outdated global payment systems like SWIFT, Garlinghouse sees the modernization opportunity as massive. “That’s a technology architecture developed 50 years ago. There’s an opportunity to modernize that […] The US is finally unlocked, and I think people are underestimating how big that change is.”

As Ripple moves forward, the company anticipates that regulatory clarity will accelerate the integration of blockchain technologies into mainstream financial services, ranging from payments to securities settlement. Garlinghouse concluded, “That will allow this innovation, allow more job creation, more innovation, and frankly capital formation here in the United States.”

At press time, XRP traded at $2.4295.

Featured image from YouTube, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.