Bitcoin appears to be on the verge of a major price movement, and data suggests that volatility could return in a big way. With Bitcoin’s price action stagnating over the past few weeks, let’s analyze the key indicators to understand the potential scale and direction of the upcoming move.

Volatility

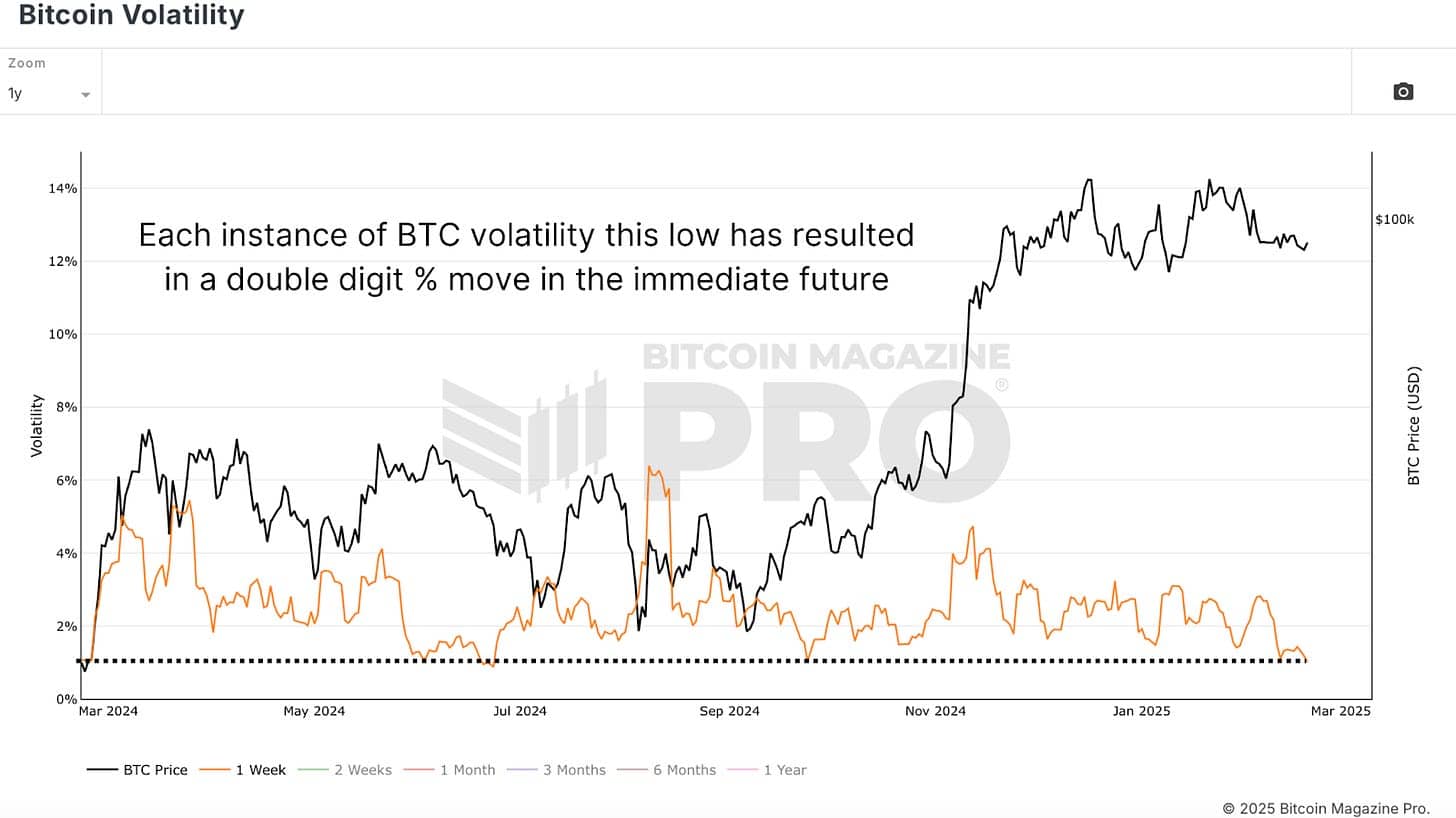

A great place to start is Bitcoin Volatility, which tracks price action and volatility over time. By isolating the past year’s data and focusing on weekly volatility, we observe that Bitcoin’s price recently has been relatively flat, hovering in the $90,000 range. This prolonged sideways action has resulted in a dramatic drop in volatility, meaning Bitcoin is experiencing some of its most stable price behavior in recent history.

Historically, such low volatility levels are rare and tend to be short-lived. When looking at previous instances where volatility was this low, Bitcoin followed up with significant price movements:

A rally from $50,000 to a then all-time high of $74,000.

A drop from $66,000 to $55,000, followed by another surge to $68,000.

A period of stagnation around $60,000 before a surge to $100,000, its current all-time high.

Every time volatility dropped to this level, Bitcoin experienced a move of at least 20-30%, if not more, in the following weeks.

Bollinger Bands

To further confirm this, the Bollinger Bands Width indicator, a tool that measures volatility by tracking price deviation from a moving average, also signals that Bitcoin is coiled for a big move. The quarterly bands are currently at their tightest levels since 2012, meaning that price compression is at an extreme. The last time this happened, Bitcoin experienced a 200% price surge within weeks.

Examining previous occurrences of similar tight Bollinger Band setups, we find:

2018: A 50% drop from $6,000 to $3,000.

2020: A breakout from $9,000 to $12,000, setting up the eventual rally to $40,000.

2023: A slow accumulation phase around $25,000 before a rapid jump to $32,000.

Potential Direction

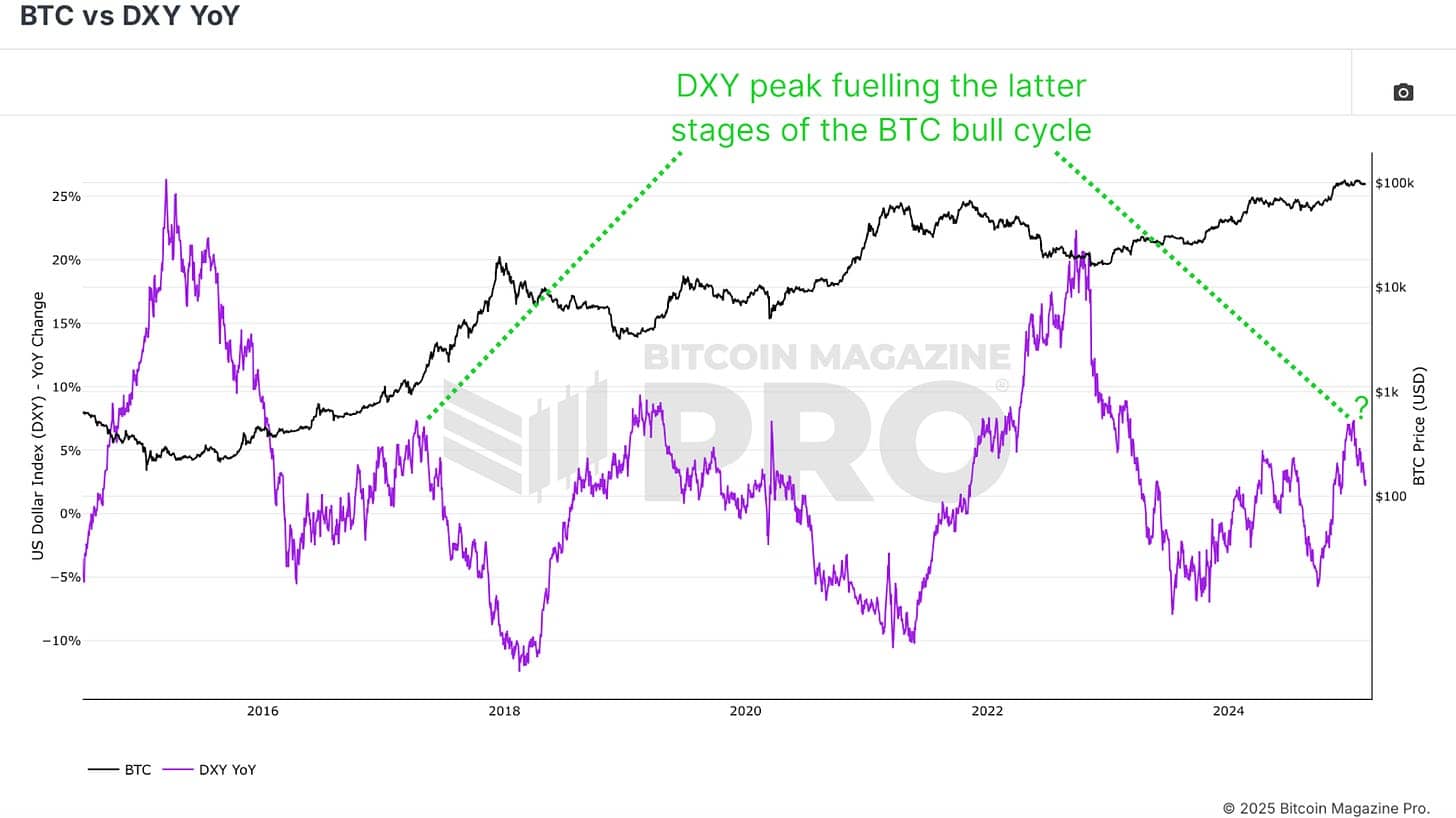

Understanding direction is harder than predicting volatility, but we have clues. One strong indicator is the US Dollar Strength Index (DXY) YoY, which has historically moved inversely to Bitcoin. Recently, the DXY has been rallying hard, yet Bitcoin has held its ground. This suggests Bitcoin has underlying strength, even in less favorable macro conditions.

Additionally, political factors may play a role. Historically, when Donald Trump took office in 2017, the DXY declined, and Bitcoin saw a massive bull run from $1,000 to $20,000. With a similar setup potentially unfolding in 2025, we may see a repeat of this dynamic.

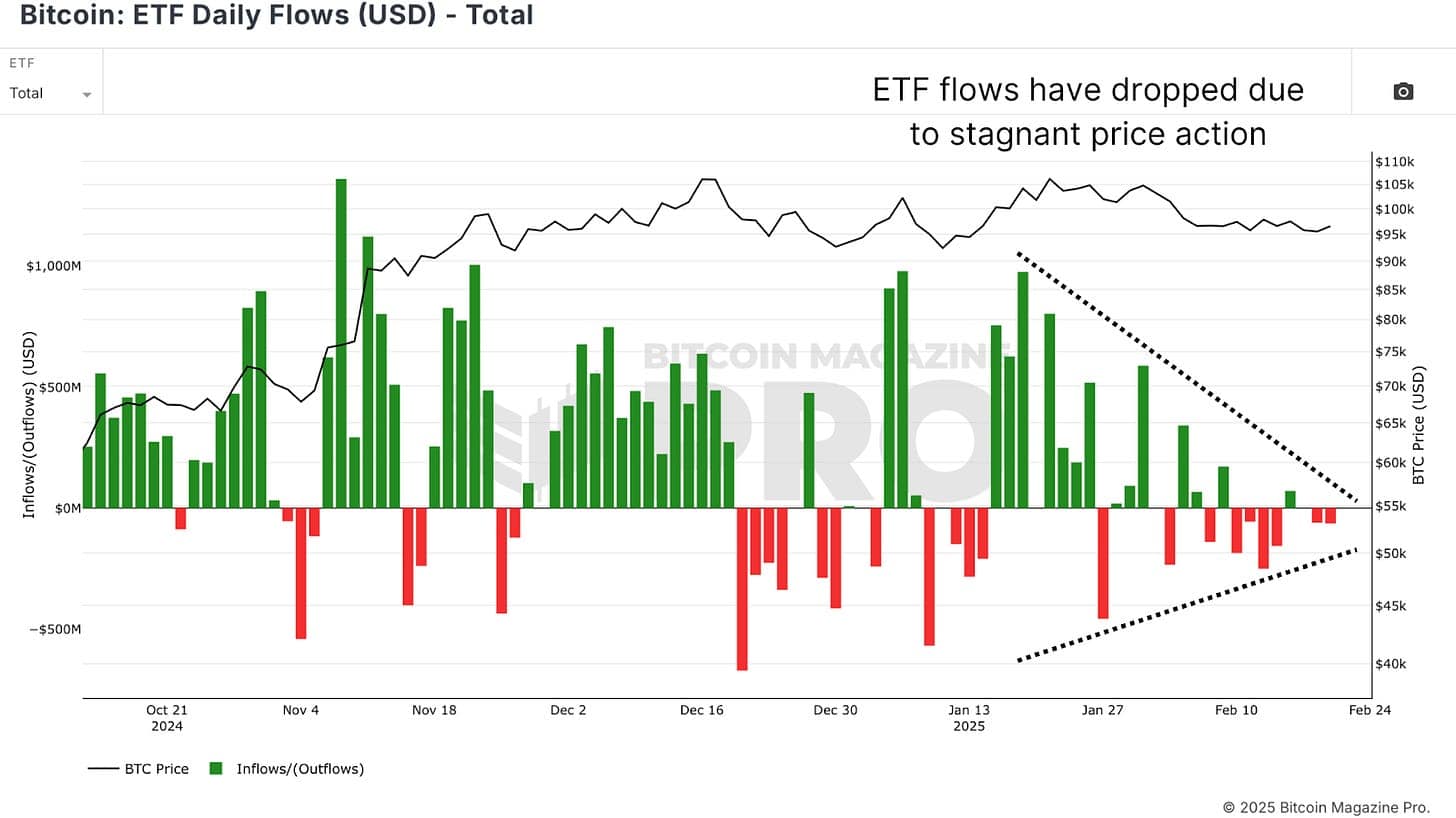

ETF Inflows

Furthermore, Bitcoin ETF inflows, a proxy for institutional demand, have slowed significantly during this period of low volatility. This suggests that major players are waiting for a confirmed breakout before adding to their positions. Once volatility returns, we could see renewed interest from institutions, driving Bitcoin even higher.

Conclusion

Bitcoin’s volatility is at one of its lowest levels in history, and such conditions have never lasted long. When volatility compresses this much, it sets the stage for an explosive move. The data suggests a breakout is imminent, but whether it leans bullish or bearish depends on macroeconomic conditions, investor sentiment, and institutional flows.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.