Even though Bitcoin has faltered since reaching a new all-time high, the largest crypto asset has remained strong at levels above the $100,000 mark. However, BTC’s recent waning performance has impacted key investors’ action as indicated in its Net Position Realized Cap metric.

Veteran Bitcoin Holders Hit The Pause Button

Bitcoin’s price is slowly recovering from its recent pullback as the asset draws closer to the $106,000 level. During the price pullback, Kyle Doops, a market expert and the host of the Crypto Banter Show, revealed a concerning trend in BTC’s on-chain data.

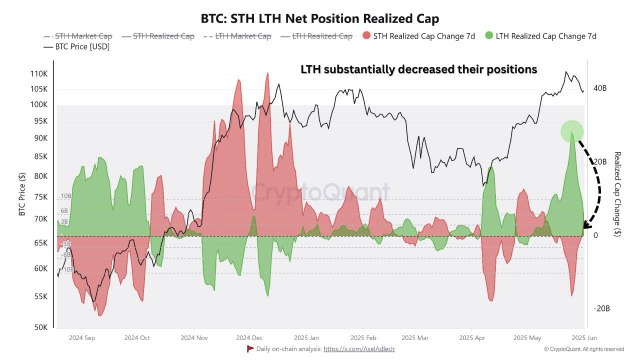

Specifically, the Bitcoin Net Position Realized Cap has dropped significantly, signaling a waning sentiment among major investors. This measure has historically been a crucial reflection of market confidence, with steep drops frequently portending uncertain times or corrective action.

Data from the crucial sentiment metric shows that the Net Position Realized Cap had fallen from $28 billion to barely $2 billion by the end of May. According to the expert, this sharp drop implies that long-term BTC holders, who are often considered the market’s backbone, have massively stepped back.

Long-term Bitcoin holders have substantially exited and decreased their positions during the recent pullback, reflecting growing profit-taking from these players. As these seasoned investors step aside, this raises concerns about the sustainability of Bitcoin price strength and whether a change in market mood is subtly taking place.

However, Kyle Doops highlighted that BTC’s recent rally is still on in spite of the huge slowdown in the Net Position Realized Cap metric. Bitcoin’s upward trend may still be on, but the expert stated that smart money is not rushing into the market. Whether the development signals caution from seasoned investors or quiet distribution, Kyle Doops believes that the key metric is worth keeping an eye on.

Big Wallet Addresses Are Selling Their BTC

In another post on X, Kyle Doops revealed a split behavior between big wallets holding 1,000 to 10,000 BTC and mid-size wallet addresses containing 100 to 1,000 BTC. Data from the Bitcoin Accumulation vs. Distribution by all cohorts metric shows that whale investors appear to be taking profits while the lesser investors are steadily stepping in to scoop up the digital gold.

During Bitcoin’s rally from the $81,000 level to the $110,000 mark, these big wallet addresses have been slowly selling their coins into the recent strength. Meanwhile, the mid-sized wallets continue to buy at a rapid rate, taking advantage of the notable upward move.

Kyle Doops mentioned that this disparity between the cohorts could be an indicator that the BTC’s ongoing rally is in the later stages. This changing dynamic suggests that supply may be redistributed and market sentiment could be reshaped, which means that mid-size investors would majorly influence BTC’s next price movement.

Featured image from Getty Images, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.