Politics aside: Borrowing dollars is damn expensive. And this only vindicates Trump. He has been right all along. A lower fund rate and the economy will see more money in circulation. Who knows, the economy might expand at an unprecedented rate. For what’s clear, MicroStrategy is buying Bitcoin at premium rates, considering that every pile of BTC bought is from borrowed funds.

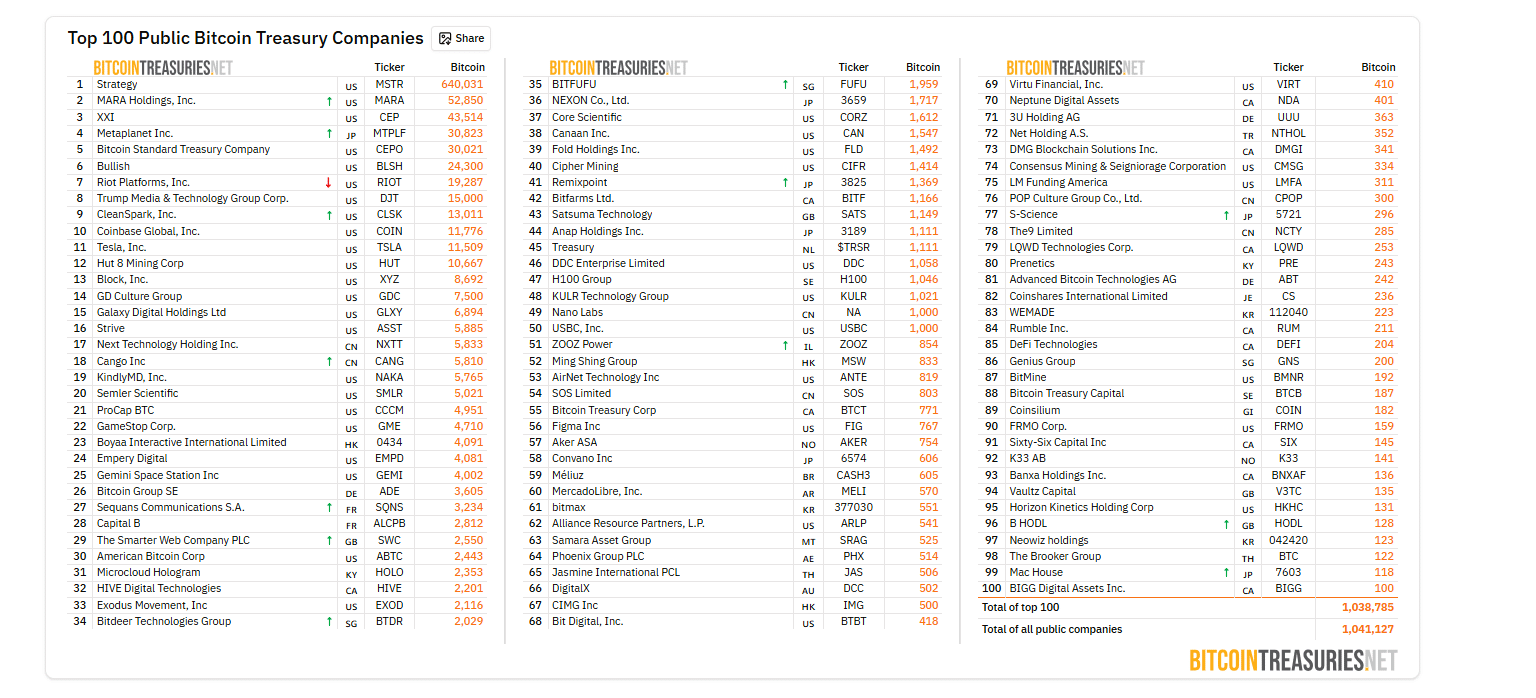

According to Bitcoin Treasuries, Strategy, formerly MicroStrategy, currently owns 640,031 BTC, more than 10X the stash held by the second largest public entity, MARA Holdings. As aggressive as Metaplanet is in buying Bitcoin, the Japanese firm is nowhere close to where Strategy is. By October 3, their holdings exceeded $77Bn, and with the Bitcoin price ticking higher, it might soon hit the $100Bn level.

(Source: Bitcoin Treasuries)

The last time Strategy bought Bitcoin was in late September when it acquired 196 BTC at $113,000 per BTC. Their average BTC acquisition price is nearly $74,000. As such, even at spot rates, Strategy is up nearly +100% in profits, which encourages stashing even more. This stance is assuming the Bitcoin price soars to as high as $150,000 in a historically bullish Q4.

(Source: Strategy, X)

DISCOVER: 9+ Best Memecoin to Buy in 2025

Strategy Will Keep Stashing Bitcoin

Regardless of market conditions, Strategy will likely continue buying more Bitcoin. Earlier this year, they announced a plan that will see the business intelligence firm raise $42Bn over three years to fund the purchase of Bitcoin. From the $42Bn, $21 billion will be issued via equity sales, while the rest, $21Bn, will be raised from fixed-income securities.

In late February, Strategy issued a +0% convertible senior notes due in 2030, raising $2Bn. From the $2Bn, they bought 20,356 BTC at an average price of $97,800. Roughly four months earlier, in late November, just when Bitcoin broke $75,000, they also issued a +0% convertible senior notes due in 2029. From this debt, they raised $5bn, buying 134,480 BTC at an average price of $89,286.

By Q1 2025, Strategy had raised $20Bn, nearly half of its $42Bn objective, to buy Bitcoin. Throughout this year, the public firm said it was well-positioned to “further enhance shareholder value by leveraging the strong support from both retail and institutional investors” in achieving its strategic plan.

The thing is, every dollar raised is expensive as the current interest rate environment stays at over +4% and is multiples higher than in other regions, especially Japan.

Will Strategy Follow Warren Buffett and Berkshire Hathaway to Japan?

The idea of borrowing cheap and buying an asset that can appreciate, earning higher yields, is compelling. Michael Saylor, the founder of MicroStrategy, is closely watching. He recently floated the idea of multi-currency borrowing to keep their “Bitcoin yield” flywheel spinning.

The Yen and Euros are on their radar as possible targets for the firm to raise funds by selling preferred shares.

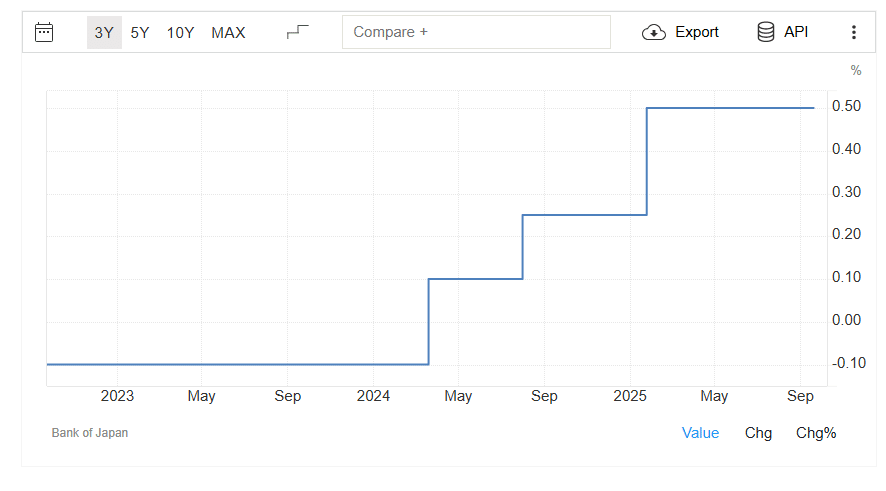

Of the two, the Yen can be a cheaper option. As of early October 2025, the Bank of Japan has interest rates steady at +0.50%. They were in negative territory before March 2024, when the central bank aggressively raised rates.

(Source: TradingEconomics)

And if they do, they won’t be the first ones, according to one analyst on X. Warren Buffett and Berkshire Hathaway have been taking advantage of the low borrowing rates in Japan for years. The ultra-low Yen debt, observers note, continues to fund Berkshire’s stakes in stable trading conglomerates in Japan.

Berkshire Hathaway $BRK has been borrowing yen in Japan at <1% with a ten-year duration. It has now invested $30 billion in Japan’s five sogo shosha (major trading houses). These companies have an annual yield of 4%. Essentially, Berkshire is arbitraging >3% + shares upside on…

— Louis (@louishliu) October 6, 2025

By issuing Samurai bonds at rates below +1% and investing the proceeds in Japan’s five major trading houses, including Mitsubishi Corporation, the American firm has continued to earn around +4% in dividend yields and even more in share appreciation, creating a net spread of over +3%, after offsetting borrowing costs.

Berkshire Hathaway has financed much of its $24 billion in Japanese holdings with fixed cost, yen denominated debt.

It pays $135 million in interest.

It receives $812 million in dividends.

Warren Buffett might be good at this macro/arbitrage thing. $BRK pic.twitter.com/IwrhKbJEmj

— Compound248  (@compound248) February 22, 2025

(@compound248) February 22, 2025

If Strategy, like Metaplanet, raises bonds targeting the Japanese markets, the firm will likely get higher yields in arbitrage spreads, up from the current +26% yield received from using USD debt.

Strategy has acquired 850 BTC for ~$99.7 million at ~$117,344 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 9/21/2025, we hodl 639,835 $BTC acquired for ~$47.33 billion at ~$73,971 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/tYNhUZvtOu

— Strategy (@Strategy) September 22, 2025

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Strategy To Follow Berkshire Hathaway and Warren Buffett?

- Strategy accumulating BTC

- Public firm now owns more than 600,000 BTC

- Japan has a low interest rate environment

- Will Strategy follow Warren Buffet and Berkshire Hathaway?

The post Can MicroStrategy Follow Warren Buffett, Berkshire Hathaway And Stash Bitcoin Using Yen? appeared first on 99Bitcoins.