In a recent in-depth video analysis, Matt Crosby, the lead analyst at Bitcoin Magazine Pro, explores the data-driven potential of Strategy’s (formerly MicroStrategy, Nasdaq: MSTR) stock to reach or exceed the $1,000 mark. You can watch the full video here: Will MicroStrategy Realistically Surpass $1,000 – Data Analysis

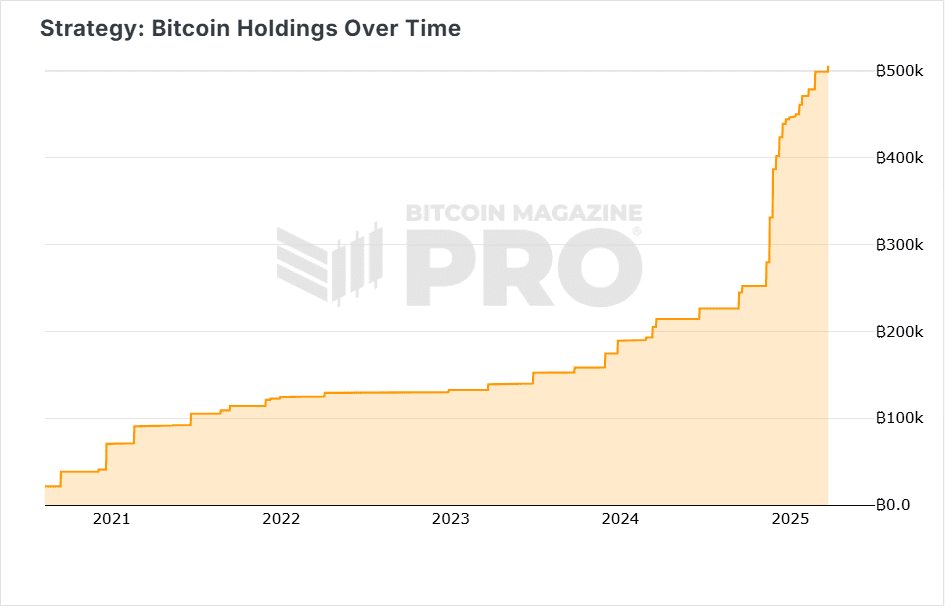

Strategy’s Strategic Bitcoin Accumulation: Over 500,000 BTC

Strategy, under the leadership of Michael Saylor, has firmly positioned itself as a Bitcoin-centric company. In less than five years, it has accumulated over 500,000 BTC—accounting for more than 2.5% of Bitcoin’s total supply—turning its stock into a proxy for Bitcoin exposure.

Strategy Data Dashboard: A New Tool from Bitcoin Magazine Pro

The video introduces the new Treasury Analytics dashboard on BitcoinMagazinePro.com. This tool provides vital insights into Strategy’s:

- Real-time Bitcoin holdings

- Net Asset Value (NAV) premiums

- Stock price data

- Historical volatility

This dashboard empowers investors to assess the intrinsic value of MSTR and its correlation to Bitcoin price movements.

Can Strategy’s MSTR Price Reach $1,000? Data-Backed Scenarios

Matt Crosby walks through multiple valuation models based on the following assumptions:

- Bitcoin price levels at $100K, $150K, and $200K

- BTC holdings expanding to 700K or even 800K BTC

- NAV premiums ranging from 2x to 3.5x

Using these inputs, Crosby outlines realistic Strategy stock price targets between $950 and $2,000. In ultra-bullish scenarios, extreme targets of $15,000 or even $25,000 are modeled, though acknowledged as speculative.

Capital Raises Fuel Future BTC Accumulation

To support further Bitcoin acquisition, Strategy is leveraging several financial instruments:

- A $2.1 billion at-the-money stock offering

- A $711 million perpetual preferred stock issuance

These capital raises could enable the company to purchase an additional 200K to 300K BTC.

MSTR Insights Based on Numbers

For investors closely tracking Strategy (MSTR), the numbers tell a powerful story:

- 500,000+ BTC Accumulated: Strategy now holds over 2.41% of all Bitcoin that will ever exist — making it the go-to public stock for BTC exposure.

- From $9 to $543: Since 2020, MSTR’s stock has soared from around $9 to over $543 (adjusted for stock splits), thanks largely to its Bitcoin accumulation strategy.

- Revenue vs. BTC Value: While Strategy pulled in $463 million in software revenue in 2024, its Bitcoin holdings are worth around $43 billion — it would take a century of software sales to match its BTC portfolio.

- Capital to Buy More BTC: The company is raising $2.1 billion through stock offerings and has already secured $711 million via preferred shares — funding that could add another 200K–300K BTC to its balance sheet.

- NAV Premiums Matter: At times, MSTR has traded at a 3.4x premium to its net asset value. The current premium is around 1.7x, with room to expand in a bullish market.

- Higher Volatility Than BTC: MSTR’s price swings are more intense than Bitcoin’s — its 3-month volatility peaked at 7.56%, compared to BTC’s 3.32%.

- Deeper Drawdowns in Bear Markets: In past down cycles, BTC lost about 80%, but MSTR fell as much as 90%, showing it tends to amplify Bitcoin’s moves.

Together, these figures highlight both the massive upside potential and the high volatility risk that come with investing in Strategy.

Strategy vs. Bitcoin: Volatility and Correlation Analysis

Crosby points out that Strategy tends to move even more sharply than Bitcoin. Over the past three months, Bitcoin’s volatility averaged around 3.32%, while MSTR’s volatility reached 7.56% — more than double.

Looking back at bear markets, Bitcoin typically retraced about 80%, but Strategy’s stock fell closer to 90%. This highlights that Strategy doesn’t just follow Bitcoin — it amplifies it. That means bigger gains in bull markets, but also steeper losses during downturns.

Limitations: Will Strategy Ever Rival Apple in Market Cap?

While the numbers might hint at sky-high stock price possibilities, reaching them is another story. For Strategy to seriously compete with tech giants like Apple, it would need to:

- Accumulate between 850,000 and 1 million BTC

- See Bitcoin’s total market cap rise above gold’s $20 trillion

- Sustain a net asset value (NAV) premium of 3x to 4x consistently

Even if all that happened, Strategy’s market cap would need to grow by 45 times to match Apple’s $3.3 trillion valuation. That kind of leap is extremely unlikely in this current cycle — it’s more of a long-term, speculative scenario.

Conclusion: Strategy’s MSTR Price Outlook is Bullish but Speculative

According to Matt Crosby’s analysis, Strategy’s MSTR price reaching $1,000 or even $2,000 is entirely within the realm of possibility during this market cycle—provided Bitcoin maintains its upward trajectory and investor sentiment remains bullish. These targets are grounded in data models that factor in current BTC holdings, potential future acquisitions, and historical NAV premiums.

However, this opportunity doesn’t come without its caveats. Strategy’s stock is known for its heightened volatility—often exceeding that of Bitcoin itself—which makes it a high-beta, high-risk investment vehicle. Investors considering MSTR should be prepared for significant price swings and prolonged drawdowns, particularly during Bitcoin market corrections.

That said, for long-term Bitcoin believers and those with a higher tolerance for risk, Strategy offers a compelling, leveraged play on the broader crypto market. With its continued accumulation strategy and substantial institutional backing, MSTR remains one of the most data-driven and high-conviction ways to gain exposure to Bitcoin’s future growth.

As always, potential investors should do their due diligence, factor in risk management strategies, and align their investments with personal financial goals and time horizons.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.