Key Takeaways

- The crypto market lost around $500 billion in reaction to Trump’s tariff announcement.

- XRP, ADA, and SOL recorded double-digit losses after their recent rallies.

Share this article

Around $500 billion has been wiped out of the crypto market in the past 24 hours ahead of Trump’s tariff deadline.

XRP, Cardano (ADA), and Solana (SOL)—the three leading crypto assets that posted major gains on Trump’s proposed crypto reserve—have now suffered steep losses, posting double-digit declines as market sentiment shifts.

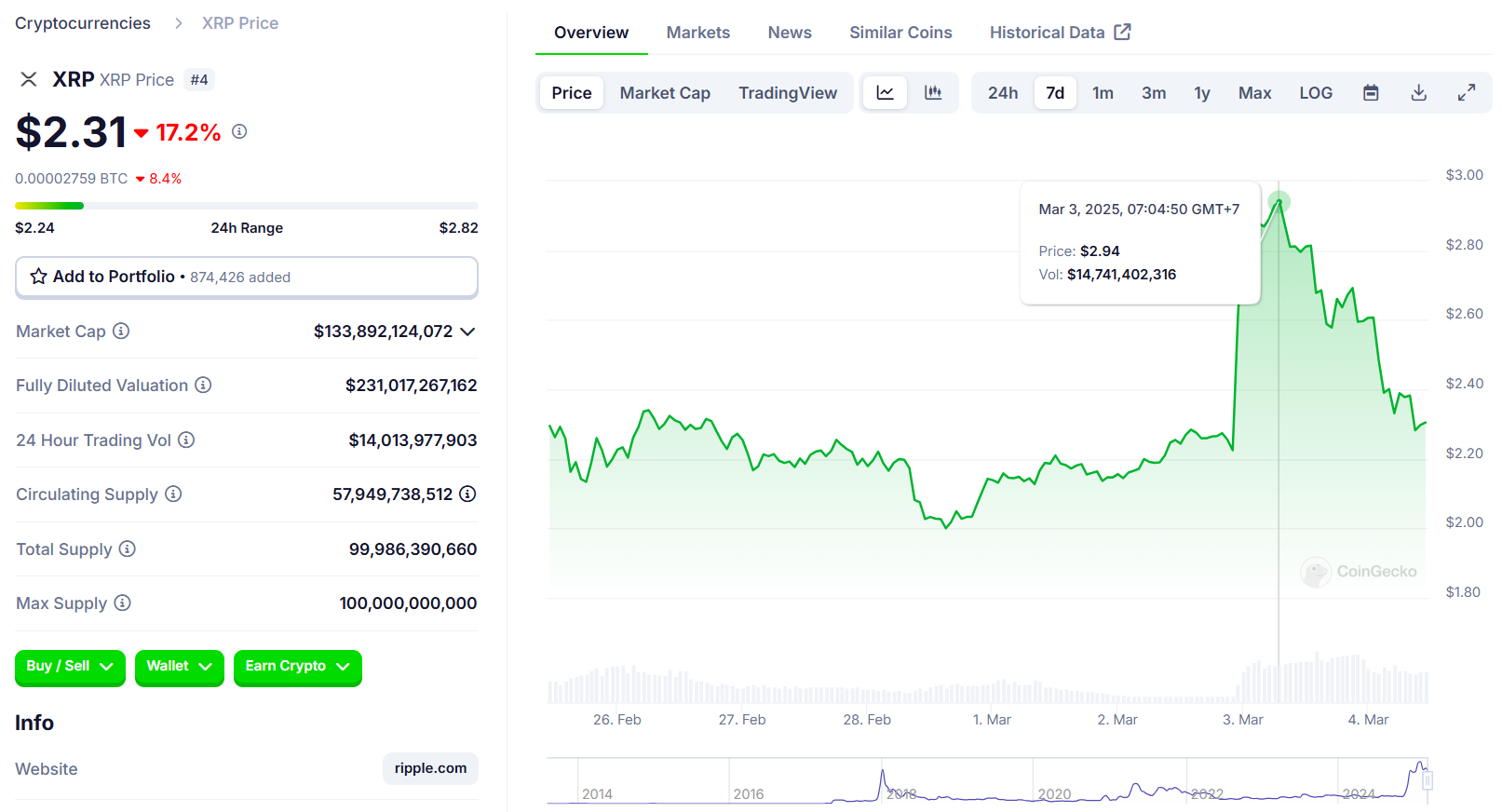

According to data from CoinGecko, XRP dropped 17% in the last 24 hours, erasing gains that followed Trump’s earlier statement about including the crypto asset in the US reserve. The asset had previously surged over 25%, reaching nearly $3.

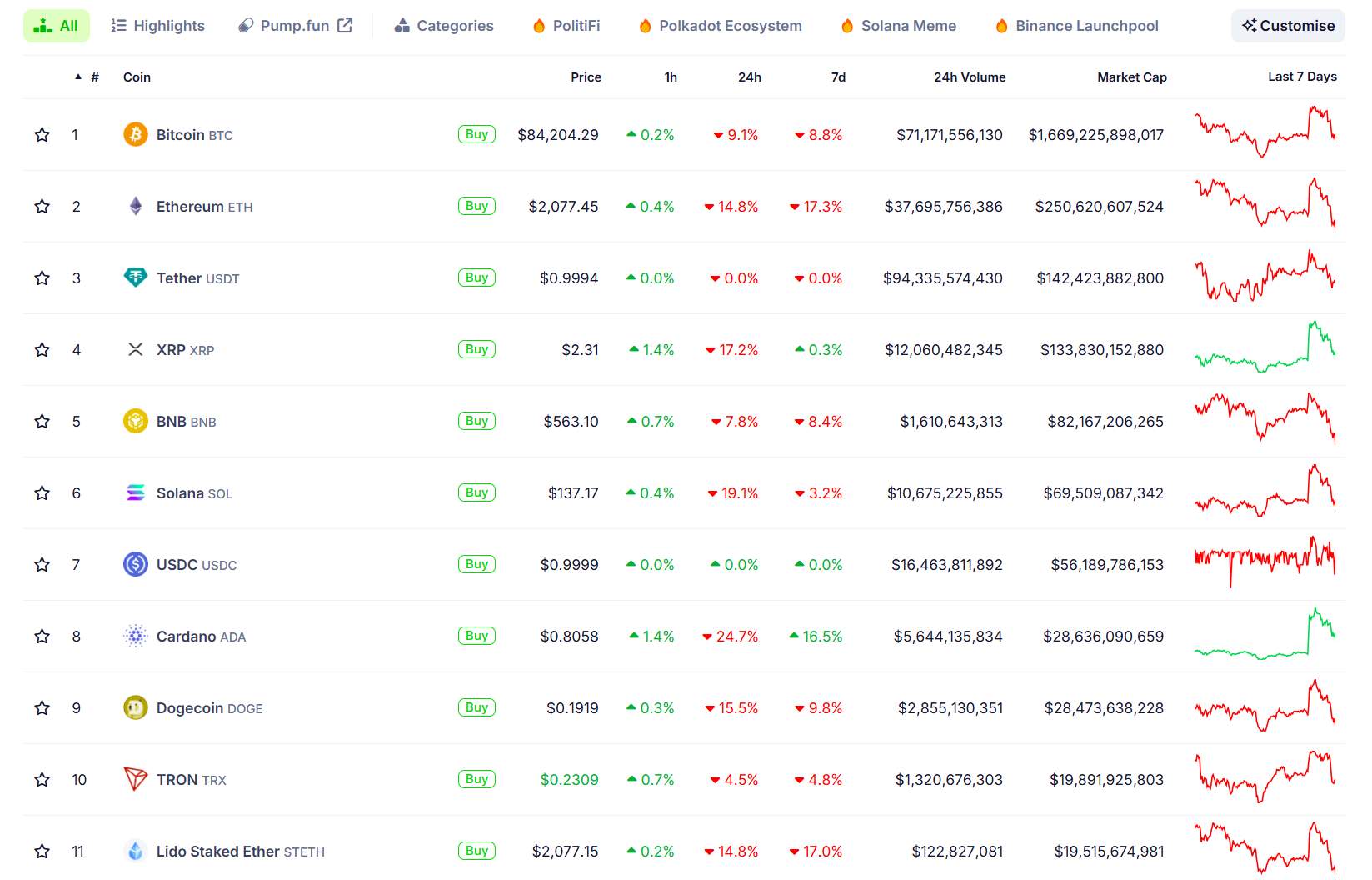

ADA and SOL experienced similar declines, falling approximately 25% and 20% respectively. ADA, which had surged over 75% to above $1 on Sunday, retreated below $0.8. SOL declined from $177 to $135.

The total crypto market cap has shrunk by over 12% over the past 24 hours. Bitcoin, after surging past $94,000 on Sunday, has pulled back. The digital asset is now trading at around $83,700, down almost 10%.

The second largest crypto asset, Ethereum, is down around 15%, while plenty of lower cap coins are down even further.

Tariffs on Canada and Mexico to take effect tomorrow

Trade war fears swiftly extinguished the hype that had built up around the US crypto reserve.

The market downturn intensified after Trump confirmed that 25% tariffs on Canada and Mexico each would take effect on Tuesday.

“They’re going to have to have a tariff. So, what they have to do is build their car plants — frankly — and other things in the United States, in which case they have no tariffs,” Trump stated.

Regarding China, the White House also announced a 20% tariff on Chinese imports. Initially, a 10% tariff was imposed, and as of March 4, 2025, an additional 10% tariff has been added.

This marks a sharp escalation in the U.S.-China trade war, with tariffs increasing much faster than during Trump’s first term.

These tariffs raise the cost of trade between the US, Canada, and Mexico, which could hurt businesses and economic growth.

Economic growth forecasts slashed

The US economy may be contracting at its fastest pace since the COVID-19 lockdown, according to the Federal Reserve Bank of Atlanta’s GDPNow model, which now projects a 2.8% decline in gross domestic product for the first quarter of 2025.

Just a month ago, the same model estimated the economy was on track for nearly four percent growth. While GDP forecasts can be volatile, other economic indicators—such as a record-high trade deficit, falling consumer confidence, and slowing spending—reinforce concerns about a deepening slowdown.

If realized, this contraction could mark the beginning of what some analysts are calling a “Trumpcession,” drawing comparisons to the sharp economic decline of 2020.

How did these affect crypto?

According to The Kobeissi Letter, mounting economic uncertainty and trade war fears have already weighed on financial markets.

The real driver here is the GLOBAL move towards the risk-off trade.

As trade war tensions rise and economic policy uncertainty broadens, ALL risky assets are falling.

This was seen in stocks, crypto and oil prices which all fell sharply today.

Safe havens are thriving. pic.twitter.com/qUFfcdWNgy

— The Kobeissi Letter (@KobeissiLetter) March 4, 2025

The financial markets have experienced a sudden sell-off in the past few hours, and the downturn was largely driven by weakness in the US stock market, triggered by recent announcements from President Trump.

The stock market downturn spilled over into crypto, as investors sold off risky assets in response to economic uncertainty. Higher tariffs could slow economic growth, reducing investor appetite for speculative assets like Bitcoin and altcoins.

Share this article