In the dynamic financial sector, Bitcoin ETFs are rapidly gaining ground against their gold counterparts, with inflows pushing total assets under management toward record highs. Bitcoin ETFs are set to overtake gold ETFs in total assets under management.

Bitcoin ETFs Cement Role As Institutional Gateway To Crypto

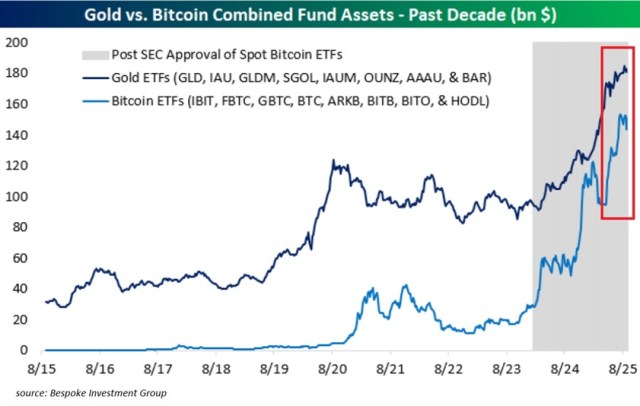

Bitcoin Exchange-Traded Funds (ETFs) are on the brink of making history globally. In an X post, the Kobeissi Letter, an industry-leading commentary on global capital markets, has revealed that BTC ETFs are on track to surpass Gold ETFs in assets under management (AUM) for the first time in history, marking a historic milestone in global markets. Over the past 12 months, AUM in the largest cryptocurrency ETFs has doubled to $150 billion, while gold ETFs have climbed 40% to a record of $180 billion.

The comparison highlights how rapidly momentum has shifted. Just three years ago, gold ETFs were five times larger than Bitcoin ETFs. Presently, with accelerating inflows into digital asset products, that gap is narrowing at a historic speed.

If current trends continue, Bitcoin ETFs could surpass gold ETFs as early as next year. This is a symbolic flip that underscores the rise of crypto from speculative asset to mainstream portfolio allocation.

Lately, ETFs are proving to be the engine behind the current crypto bull market. According to Ucan_Coin, BlackRock, the world’s largest asset manager, oversees nearly 2,000 funds, with about 1,400 of them being ETFs. Clients buy into these funds, while BlackRock earns fees on the assets under management.

However, the Bitcoin Spot ETF fee is just 0.25%, but the power lies in scale and liquidity. Over the last two years, ETFs have provided the critical fuel for this rally, with nearly 20% of all liquidity entering crypto now flowing directly from ETF products.

As Ucan_Coin highlights, BlackRock’s IBIT stands out. As the chart demonstrates, IBIT is the locomotive pulling the entire market, driving inflows and setting the pace for the broader bull run.

ETF Inflows Signal Rising Institutional Appetite For Bitcoin

The US spot Bitcoin ETFs are gaining remarkable momentum, while generating $5 to $10 billion in daily volume on their most active trading days. Pushpendra Singh, Co-founder of PushpendraTech and SmartViewAi, has explained that this surge is a clear sign that institutional investors are increasingly seeking regulated exposure to Bitcoin, and ETFs are rapidly becoming their preferred gateway.

Despite the ETF boom, Binance continues to dominate the spot market, processing between $10 to $18 billion in daily spot volume and holding a 29% market share. This is more than double the 13% market share currently held by US-based ETFs, and it puts Binance comfortably ahead of other major exchanges in terms of liquidity.

Featured image from Getty Images, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.