Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

The on-chain analytics firm Glassnode has explained how Bitcoin investor behavior tends to reflect in price trend reversals and continuations.

Glassnode Highlights Key Behavioral Patterns Behind Bitcoin Moves

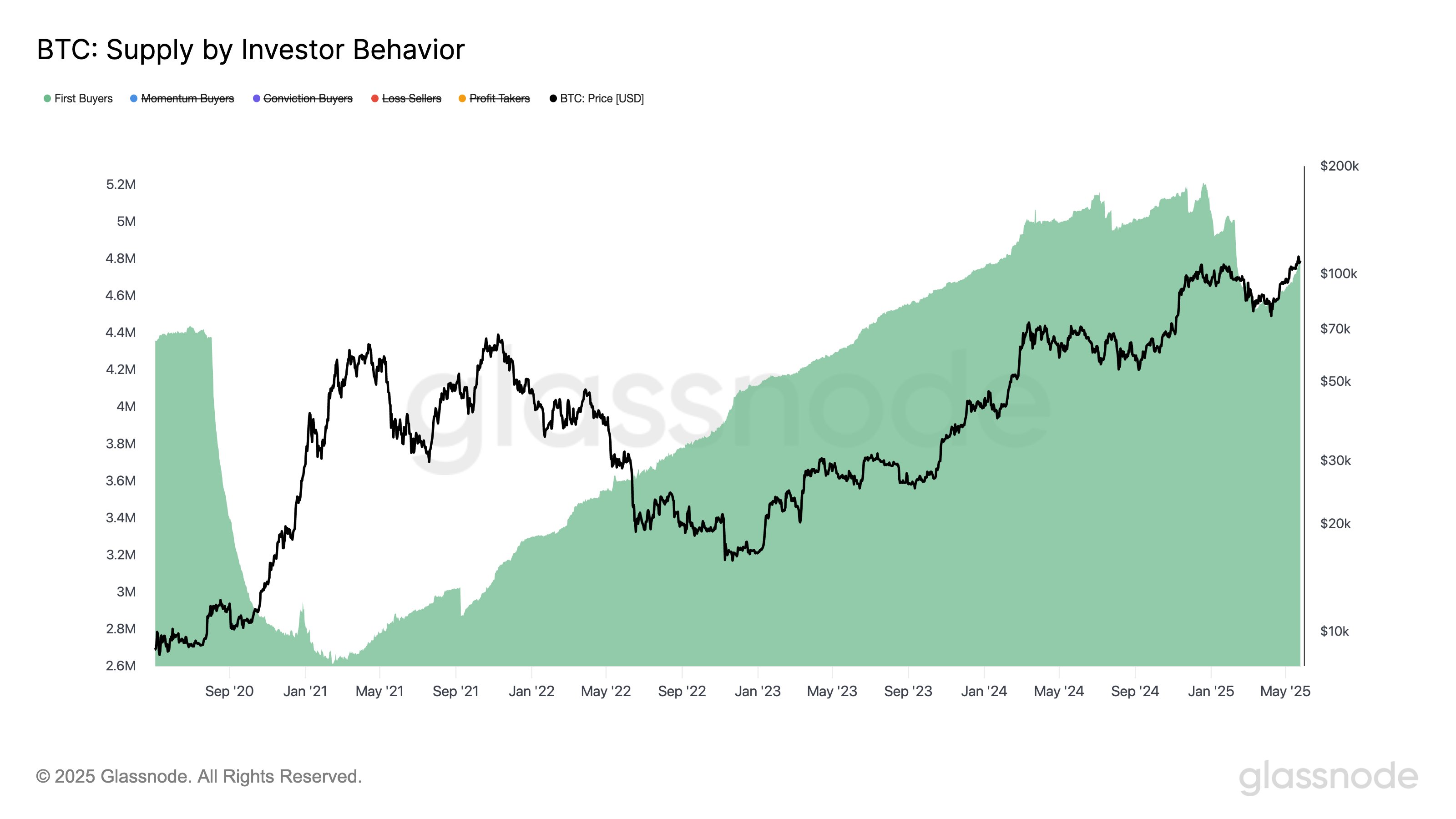

In a new thread on X, Glassnode has shared a new way to categorize Bitcoin investors based on their on-chain spending patterns. Under this indicator, called the Supply by Investor Behavior, there are five cohorts: Conviction Buyers, First Buyers, Momentum Buyers, Loss Sellers, and Profit Takers.

First Buyers, Loss Sellers, and Profit Takers are pretty self-explanatory. Conviction Buyers refer to the investors who buy despite a decline in the cryptocurrency’s price, while Momentum Buyers refer to those who buy during uptrends.

Related Reading

“The metric tracks the cumulative token supply held by each cohort over time,” notes the analytics firm in the chart’s description on its website. “To focus solely on investor behavior, we exclude exchanges and smart contracts.”

Here is the chart shared by Glassnode that shows the trend in the indicator over Bitcoin’s history:

To showcase how the behavior of these groups has an effect on the asset’s trajectory, the analytics firm has zoomed in on the data of two cohorts: Conviction Buyers and First Buyers.

First, here is the chart specifically for the Bitcoin Conviction Buyers:

From the graph, it’s visible that the BTC supply held by the Conviction Buyers generally observes a spike alongside inflection points in the cryptocurrency’s price. In particular, their supply tends to reach a peak coinciding with bear market lows. These investors also step in to buy dips during uptrends, helping stabilize pullbacks.

“But conviction alone isn’t enough to spark a rally – that’s where First Buyers come in,” explains Glassnode. Below is a chart that highlights the role of the First Buyers.

As displayed in the chart, demand from First Buyers went up alongside Bitcoin’s recovery out of the bear market, with a particularly sharp surge coinciding with the bull rally in Q1 2024.

Related Reading

The supply of the First Buyers let off during the consolidation phase that followed this rally, but demand returned in the second half of the year, helping fuel the run beyond $100,000.

The Bitcoin market downturn this year again accompanied a decline in the supply of the First Buyers, this time to a much stronger degree than last year’s drawdown. New capital inflows seem to have made a sharp return once more, however, as the metric’s value has switched to rapid growth, potentially explaining the rally to the new all-time high.

BTC Price

At the time of writing, Bitcoin is trading around $109,800, up over 4% in the past week.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com