MicroStrategy—now operating as Strategy™—has built the most aggressive Bitcoin treasury in the world. But its true innovation isn’t just holding Bitcoin. It’s in how it finances the accumulation of Bitcoin at scale without giving up control or diluting shareholder value.

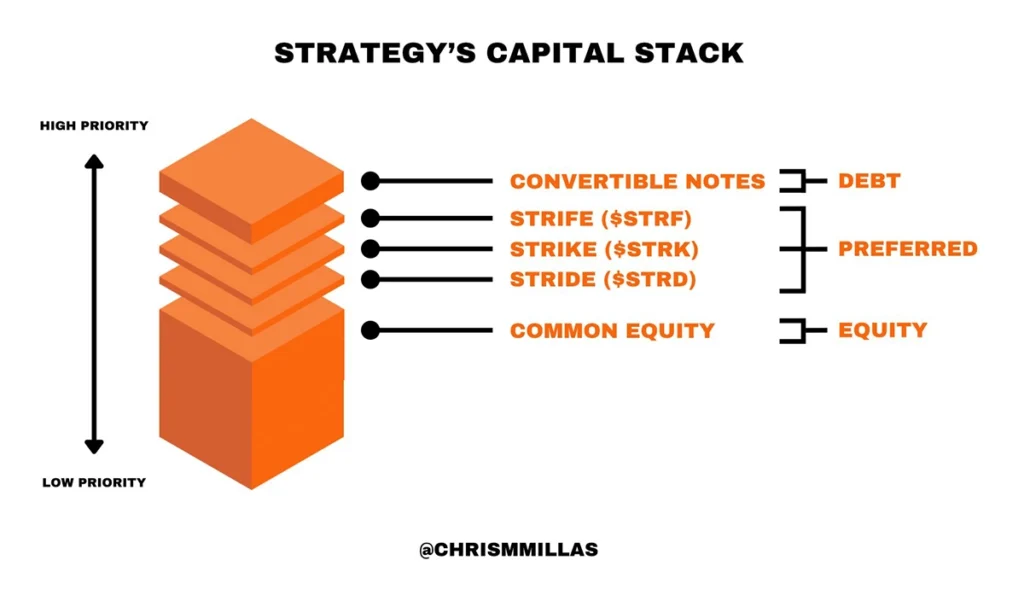

The engine behind this? A meticulously designed capital stack—a multi-tiered structure of debt, preferred stock, and equity that appeals to different types of investors, each with unique risk, yield, and volatility preferences.

This is more than corporate finance—it’s a blueprint for Bitcoin-native capital formation.

What Is a Capital Stack?

A capital stack refers to the layers of capital a company uses to finance its operations and strategic goals. Each layer has its own return profile, risk level, and repayment priority in the event of liquidation.

Strategy’s capital stack is designed to do one thing exceptionally well: convert fiat capital into Bitcoin exposure—efficiently, at scale, and without compromise.

The Stack: Ordered by Priority

Strategy’s capital stack comprises five core instruments:

1. Convertible Notes

2. Strife Preferred Stock ($STRF)

3. Strike Preferred Stock ($STRK)

4. Stride Preferred Stock ($STRD)

5. Common Equity ($MSTR)

These layers are ranked from highest to lowest in repayment priority. What makes this structure unique is how each layer balances downside protection, yield, and Bitcoin exposure—offering institutional investors fixed-income alternatives with varying degrees of correlation to Bitcoin.

Convertible Notes: Senior Debt with Optional Upside

Strategy’s capital stack begins with convertible notes—senior unsecured debt that can convert into equity.

- Downside: Low risk, high priority in liquidation

- Upside: Modest unless converted

- Appeal: Institutional debt investors seeking protection with optional Bitcoin-adjacent upside

These notes were Strategy’s earliest fundraising tools, enabling the company to raise billions in low-interest environments to accumulate Bitcoin without issuing equity.

Strife ($STRF): Investment-Grade Yield

Strife is a perpetual preferred stock designed to mimic high-grade fixed income.

- 10% cumulative dividend, paid in cash

- $100 liquidation preference

- No conversion rights or Bitcoin upside

- Compounding penalties on unpaid dividends

- Low volatility, medium risk profile

Strife targets conservative capital—allocators who want predictable income without equity or crypto exposure. It’s senior to other preferreds and common stock, making it a high-quality fixed-income proxy built atop a Bitcoin treasury.

Strike ($STRK): Yield + Bitcoin Optionality

Strike is convertible preferred stock—bridging fixed income and equity upside.

- 8% cumulative dividend

- Convertible into $MSTR at $1,000 strike

- Paid in cash or Class A shares

- Bitcoin exposure via conversion option

- Medium volatility, low risk

Strike appeals to investors who want income with optional participation in Bitcoin upside. In bullish Bitcoin cycles, the conversion option becomes valuable—offering a hybrid between bond-like stability and equity-like potential.

Stride ($STRD): High Yield, High Risk

Stride is the most junior preferred—non-cumulative, perpetual stock issued with high yield and few protections.

- >10% dividend, only if declared

- No compounding, no conversion, no voting rights

- Highest relative risk among preferreds

- Liquidation priority above common equity, but below all others

Stride plays a crucial role. Its issuance improves the credit quality of Strife, adding a subordinate capital buffer beneath it—similar to how mezzanine debt protects senior tranches in structured finance.

Stride attracts yield-hungry investors, enabling Strategy to raise capital without compromising more senior layers.

Common Equity ($MSTR): Pure Bitcoin Beta

At the base is Strategy’s common equity—the most volatile, least protected, but highest potential instrument in the stack.

- Unlimited upside

- No dividend, no priority

- Full exposure to Bitcoin volatility

- Voting rights, long-term ownership

Common equity is for conviction-driven investors. Over the past four years, this layer has attracted capital from funds and individuals aligned with Strategy’s Bitcoin thesis—investors who want maximal upside from a corporate Bitcoin strategy.

The Big Picture: Saylor Is Targeting the Fixed Income Market

This isn’t just a financing mechanism—it’s a direct challenge to the $130 trillion global bond market.

By issuing instruments like $STRF, $STRK, and $STRD, Strategy is offering Bitcoin-adjacent yield vehicles that absorb demand from across the capital spectrum:

- Institutional investors seeking investment-grade yield

- Hedge funds chasing structured upside

- Yield hunters willing to go down the stack for returns

Each instrument behaves like a synthetic bond, yet all are backed by a Bitcoin accumulation engine.

As Director of Bitcoin Strategy at Metaplanet, Dylan LeClair put it: “Saylor is coming for the entire fixed income market.”

Rather than issue traditional bonds, Saylor is constructing a Bitcoin-native capital stack—one that unlocks liquidity without ever selling the underlying asset.

Why It Matters: A Model for Bitcoin Treasury Strategy

Strategy’s capital structure is more than innovation—it’s a financial operating system for any public company that wants to monetize Bitcoin’s rise while maintaining capital discipline.

Key takeaways:

- Every layer matches a specific investor need: From low-risk debt to speculative yield

- Capital flows in, Bitcoin stays put: Preserving treasury position while scaling

- No single instrument dominates: The stack is diversified by design

- Control is retained: Most securities are non-voting, non-convertible

For corporations serious about building a Bitcoin-native balance sheet, this is the playbook to study.

Saylor isn’t just stacking Bitcoin—he’s engineering the financial infrastructure for a monetary paradigm shift.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.