Regulations are crucial in crypto. Without supportive government frameworks, navigating the landscape becomes extraordinarily challenging. In 2025, with Donald Trump in the White House, the U.S. is leading the charge as far as regulatory clarity is concerned. So far, DeFi and tokenization projects have been leading the charge via the GENIUS Act, for example. However, DePin initiatives are starting to make equally compelling strides.

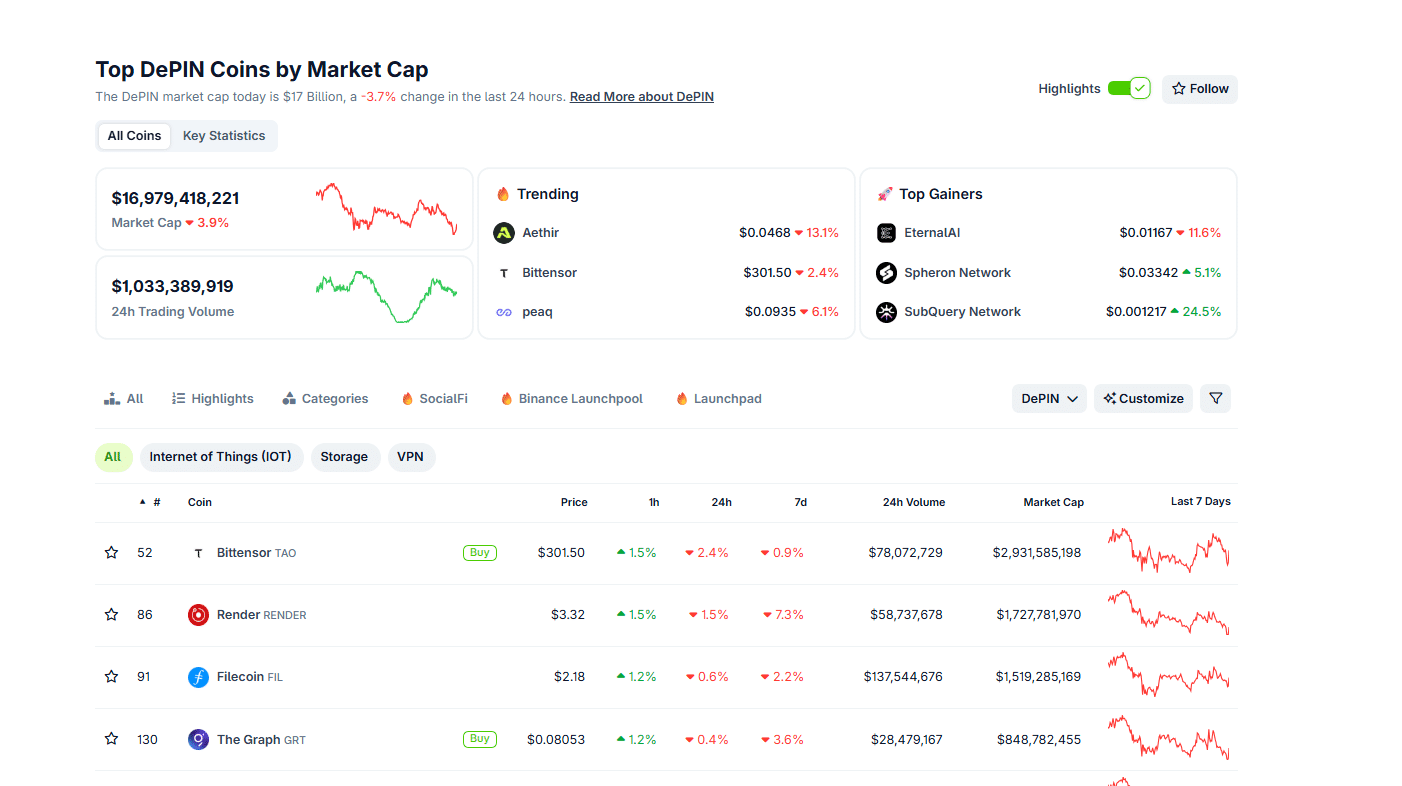

This is a huge win, especially since crypto’s core promise is to boost efficiency and empower end users with greater control. Victories for projects that advance these goals are essential. According to Coingecko, DePin is a burgeoning crypto subsector overseeing over $16.9Bn in assets. Herein, some of the best cryptos to buy include Bittensor, Render, and Filecoin. Yet many emerging DePin projects are explicitly built for Solana, where recent regulatory developments could profoundly influence the sector’s trajectory.

(Source: Coingecko)

At the center of this is DoubleZero, a DePin platform aiming to streamline blockchain consensus with a sharp focus on Solana. The team is laser-focused on enhancing Solana’s scalability by minimizing data travel between validators, potentially pushing throughput to 1M TPS. At its core, DoubleZero weaves together underutilized private fiber-optic links into a network for powering dapps.

DISCOVER: 10+ Next Crypto to 100X In 2025

DoubleZero, the SEC, and the No-Action Letter

DoubleZero’s ambitions are bold, but the team knows that regulatory compliance, particularly in the United States, is non-negotiable.

In a rare show of restraint, the SEC issued a no-action letter to DoubleZero on September 29, effectively approving the project’s programmatic distribution of 2Z tokens.

Responding to an inquiry from DoubleZero, the agency’s Division of Corporation Finance stated it would not recommend enforcement action against the project or its smart contracts facilitating 2Z token transfers; provided the facts remain unchanged and the token functions purely as a utility.

Proud to share that the @SECGov has issued @DoubleZero a No-Action Letter for 2Z.

The first-of-its-kind No-Action Letter gives us confidence that 2Z does not have to register as a class of “equity securities” and that programmatic flows of 2Z on the DoubleZero network are… pic.twitter.com/gSgiN6tpQj

— DoubleZero IBRL/acc (@doublezero) September 29, 2025

Critically, the SEC determined that 2Z tokens do not meet the Howey Test, the Supreme Court standard for identifying investment contracts (and thus securities) versus commodities. The reasoning? Rewards for 2Z are driven by participants’ efforts, not DoubleZero’s promotional activities.

Like many tokens, including those listed on Binance, 2Z will incentivize network participants. The SEC opined that these tokens are not securities under federal law. This ruling arrives just ahead of DoubleZero’s mainnet beta launch on October 2.

Validators must pay in 2Z for connectivity to join the network, while providers earn algorithmic rewards based on contributions such as bandwidth and latency enhancements. A share of fees is burned to combat inflation, and holders have the option to stake 2Z for additional yields.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

A Breakthrough for DePin? What It Means For Platforms Like Helium

The crypto community has warmly embraced the no-action letter. It makes sense: These letters are fact-specific, non-binding staff opinions rather than formal rules, but serve as valuable compliance guideposts.

DoubleZero’s legal counsel, Cooley LLP, described the SEC’s response as a “major milestone in the regulation of crypto assets” that could foster “a potential path for crypto projects to compliantly distribute tokens in the United States.”

Crypto-friendly SEC Commissioner Hester Peirce echoed this sentiment, noting that the guidance paves the way for further experimentation. She notes that “markets, not financial regulators, should determine the success” of crypto projects.

On X, Helium, a decentralized wireless network, hailed the SEC’s stance on DoubleZero’s token as a “great day” for DePin.

Earlier this year, the agency had sued Helium’s developer, Nova Labs, claiming its native HNT token was an unregistered security.

Today marks a major win for Helium and The People’s Network! The SEC has agreed to dismiss its unregistered securities claims with prejudice. Helium Hotspots and the distribution of HNT, MOBILE, and IOT through the Helium Network are not securities. It also means that the SEC… pic.twitter.com/vJSBAFht8T

— Helium (@helium) April 10, 2025

(@helium) April 10, 2025

However, by April 2025, the SEC had dismissed the case, and Nova Labs agreed to a modest $200,000 civil penalty, far short of the $42M originally sought.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

SEC No-Action Letter Massive Win for DePin Projects Like Helium?

- DoubleZero aims to improve data travel time between Solana validators

- Plans to issue 2Z tokens via programmatic transfers

- SEC staff issues a no-action letter against 2Z

- Will this boost DePin innovation?

The post Is This SEC No-Action Letter a Massive Win for DePin Projects Like Helium? appeared first on 99Bitcoins.