After reaching a new all-time high of $112,000, Bitcoin is now consolidating just below this level, holding strong above the key $106,000 support zone. Despite short-term resistance, the broader structure remains bullish, with analysts expecting an impulsive move once BTC reclaims higher ground. With global markets facing heightened economic uncertainty, Bitcoin continues to show resilience, thriving as a hedge and outperforming traditional risk assets.

Market sentiment remains positive as on-chain signals strengthen the bullish outlook. According to new data from Glassnode, spending by older Bitcoin holders is heating up once again. Aggregate transaction volume from the 1-year to 5-year holding cohorts has surged to $4.02 billion, marking the highest level since February. This uptick in long-term holder activity often precedes major market shifts, as veteran participants begin to reposition.

While some view this as potential profit-taking, it also signals renewed confidence and market engagement from experienced holders. As BTC consolidates near record highs, this behavior could reflect long-term investors preparing for broader market participation in the next leg up.

Bitcoin Faces Pivotal Test as Long-Term Holders Move Billions

Bitcoin is facing a critical moment as it consolidates just below its all-time high near $112,000. After rallying more than 50% since its April low, BTC now needs to hold above the $106K–$108K zone and decisively push past the $112K level to confirm a new bullish impulse. The coming days are likely to set the tone for the next leg of this cycle.

Macroeconomic tensions are intensifying, with US and Japanese treasury yields flashing signs of systemic stress. In this climate, Bitcoin appears to be thriving as a hedge against traditional financial instability. Its non-sovereign, decentralized nature continues to attract capital in times of uncertainty, and the recent price action suggests that trend is gaining strength.

On-chain data from Glassnode adds further depth to the picture. Spending by older Bitcoin holders—those in the 1–5 year cohort—has surged, with aggregate volume reaching $4.02 billion, the highest since February. The breakdown reveals notable outflows from long-term wallets:

- 3–5 year cohort: $2.16B (second-largest this cycle, behind March 2024’s $6B)

- 2–3 year cohort: $1.41B

- 1–2 year cohort: $450M

This marks the fifth-largest 1–5 year spending spike of the current cycle, driven primarily by holders with three or more years of holding time. While some interpret this as profit-taking, it may also signal conviction among experienced participants rotating capital or positioning for further gains.

With technical support holding and liquidity steadily returning, Bitcoin is on the verge of what could be a major breakout. A clean move above $112K with volume would validate the next phase of the bull market—and potentially open the door to $120K and beyond.

BTC Consolidates Below ATH As Bulls Defend Key Levels

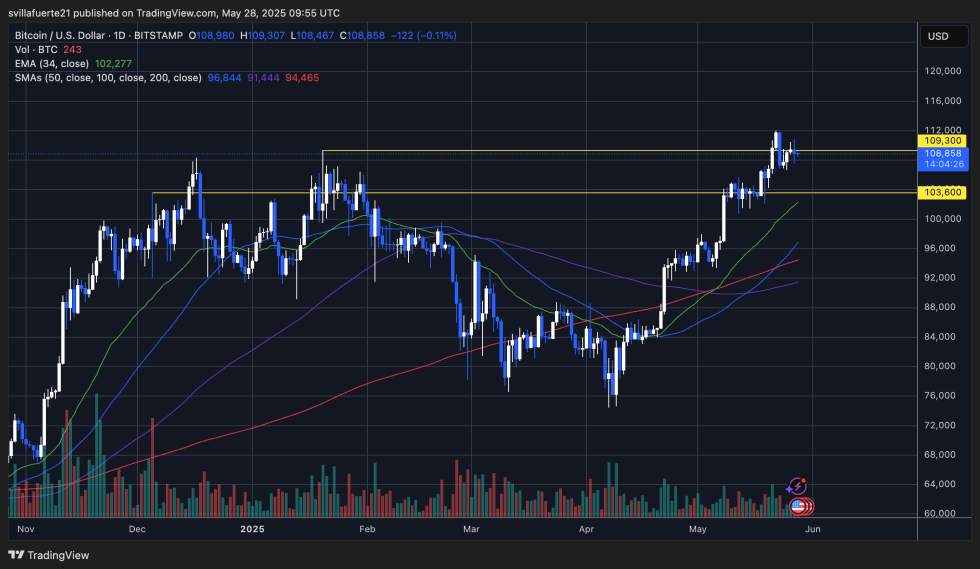

Bitcoin is trading at $108,858 on the daily chart, consolidating just below its recent all-time high of $112,000. Price action shows that BTC is holding above the previous resistance zone turned support near $103,600, a level that provided the base for May’s breakout. The market structure remains bullish, with Bitcoin printing a series of higher highs and higher lows since its April bottom.

The 34 EMA (green) at $102,277 and the 50 SMA (blue) at $96,844 are both trending upward, reinforcing a strong medium-term uptrend. These moving averages now act as dynamic support in the event of any pullbacks. Volume has slightly decreased during this consolidation, which is typical after a strong impulse move, suggesting that the market is pausing before its next major decision.

To resume the bullish trend, BTC needs to close convincingly above the $112K mark. A breakout with strong volume could open the door to a rapid move toward $120K and beyond. On the downside, maintaining support above $103,600 is crucial to avoid a deeper retracement.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.