Join Our Telegram channel to stay up to date on breaking news coverage

Robinhood CEO Vlad Tenev says tokenization is a “freight train” set to take over the financial system, predicting crypto and banks will converge on-chain, with stocks, deposits, and other financial products represented as digital tokens.

“Eventually, it’s going to eat the entire financial system,” he said, highlighting how blockchain could handle everything from trades to payments, making traditional and crypto systems indistinguishable.

Crypto and traditional finance have been living in separate worlds until now, Tenev said at the Token2049 conference in Singapore. But that’s set to change as they begin to “fully merge” and everything goes on-chain “in some form,”

“I think that crypto technology has so many advantages over the traditional way we’re doing things that in the future there’s going to be no distinction,” Tenev said, estimating it may take a decade or more for almost the entire world to participate in tokenization.

US May Take Longer To Embrace Tokenization

The US may take longer to fully embrace tokenization because its existing financial infrastructure already functions effectively, he said. Because of that, the cost to increase the current system’s efficiency incrementally might not be worth it right now.

“So the incremental effort to move to fully tokenized will just take longer,” he said.

While Tenev predicts that it will take longer for the US to go fully on-chain, big American banks have already started exploring blockchain technology and tokenization.

One of those banks is Wall Street giant JPMorgan Chase, which has launched its own permissioned USD deposit token called JPMD on the Ethereum layer-2 Base network for institutional clients.

The bank has also completed its first tokenized US Treasury trade on a public blockchain through a collaboration with Chainlink and Ondo Finance.

Goldman Sachs has also partnered with BNY Mellon to bring tokenized money market fund instruments to their clients.

Meanwhile, Citigroup is reportedly exploring issuing its own stablecoin and expanding into tokenized deposits as well as digital asset custody services. Bank of America has also expressed interest in tokenizing real-world assets.

Tokenization Will Be To Stocks What Stablecoins Have Been To The Dollar

Tenev went on to highlight how USD-pegged stablecoins have made it easy for offshore investors to gain exposure to the greenback, and subsequently predicted that tokenized stocks will enable offshore investors to buy into US equities.

He added that tokenized stocks will be “the future of how global investors will hold US assets.”

Robinhood has already launched a tokenized stock offering in Europe, which gives European investors the ability to invest in popular US companies such as SpaceX and OpenAI.

Shortly after the offering was launched, OpenAI called the move to tokenize its private shares “unauthorized” and lawyers said that the move walked a legal tightrope.

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer.

Please be careful.

— OpenAI Newsroom (@OpenAINewsroom) July 2, 2025

However, Tenev dismissed the controversy as part of a regulatory lag, and said that the main hurdles to tokenized stocks aren’t technical but legal.

USDC Issuer Expands Its Tokenized Treasury Fund To Solana As RWA Market Soars

USD Coin (USDC) issuer Circle is trying to position itself early as the tokenization market begins to swell.

JUST IN: USYC is live on Solana 🪙

USYC brings shares of a US government money market fund that accrues yield via price per share and redeems to/from USDC in real time pic.twitter.com/qAijGO6AdL

— Solana (@solana) October 1, 2025

The firm recently announced that it has expanded its US Treasury fund offering to the lightning-fast layer-1 blockchain Solana. This expands the USYC token’s reach beyond Ethereum, Near, Base, Canton, and the planned addition of the BNB Chain.

USYC is a tokenized version of a short-duration US government money market fund, and is redeemable in real time for Circle’s USDC stablecoin. The offering is only available to non-US investors who pass know-your-customer (KYC) checks.

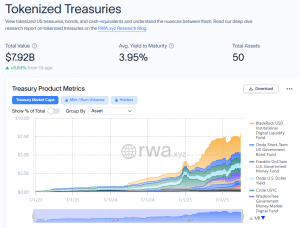

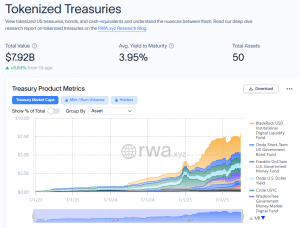

The announcement that USYC has been expanded to the Solana network comes after the broader tokenized treasury market has seen strong growth recently. According to data from RWA.xyz, the market has soared from $2.4 billion a year ago to nearly $8 billion now.

That’s after the market grew by more than 9% over just the past week.

Tokenized treasury market overview (Source: RWA.xyz)

Of that nearly $8 billion market cap, Circle’s USYC is the fifth-largest tokenized treasury fund in the market.

Tokenized real-world asset coins have also seen their market cap rise by more than 5% in the past 24 hours, according to data from CoinGecko.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage