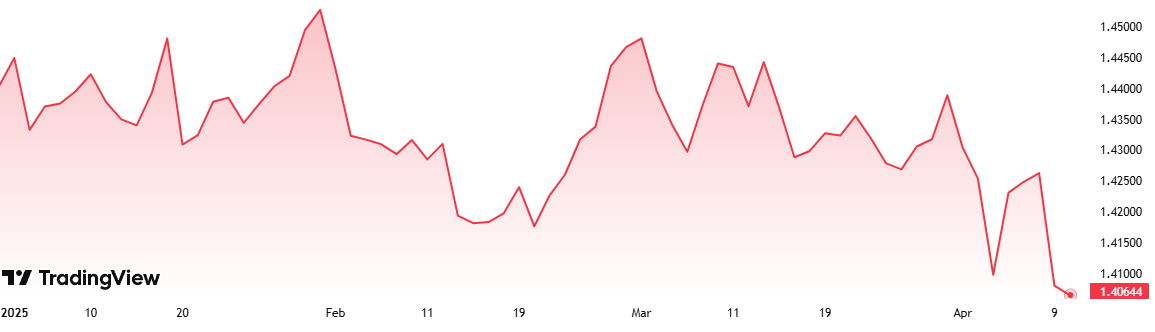

The USD/CAD currency pair has experienced significant volatility in recent days, plunging below the 1.4200 mark as the US Dollar (USD) faces intense selling pressure amid growing concerns of a US recession. The US Dollar has been hit particularly hard by escalating trade tensions between the United States and China, which have intensified the risks of a global economic slowdown.

As a result, the Loonie (CAD) has gained strength, with the USD/CAD pair falling sharply to around 1.4180 during European trading hours on Wednesday. TelaraX professionals examine this subject comprehensively in the article.

Escalating US-China Trade War

At the heart of the USD/CAD’s recent struggles is the ongoing US-China trade war, which has rapidly escalated in recent weeks. The US recently announced an increase in reciprocal tariffs on China to 84% in response to China’s retaliatory tariffs on US products.

This move follows China’s decision to impose a 34% import duty on products from the US, which began last week. The heightened tensions have resulted in a sharp drop in market sentiment, triggering a sell-off of the US Dollar.

The US Dollar Index (DXY), which tracks the performance of the Greenback against a basket of six major currencies, has also faced pressure, tumbling to near 102.00. This drop is indicative of a broader USD weakness as investors react to the increasing tariffs and the potential economic fallout from a prolonged trade conflict.

Canada’s Counter-Tariffs and Volatility in the CAD

While the US Dollar is struggling, the Canadian Dollar (CAD) is also facing its challenges. On April 9, Canada’s counter-tariffs on US imports, which were announced last week, came into effect. These 25% counter-tariffs primarily target automobile imports from the United States, significantly affecting the US auto industry.

The Canadian government has made it clear that these measures will remain in place until the US removes its tariffs against the Canadian auto sector. With both the US and Canada imposing tariffs on each other, the Canadian Dollar is expected to remain volatile, reflecting the ongoing tensions and uncertainties surrounding the trade dispute.

Fears of a US Economic Slowdown

The recession fears in the US economy are growing amid the escalating trade war, with traders increasingly betting that the Federal Reserve (Fed) will be forced to cut interest rates to mitigate the economic damage. Financial market participants are bracing for the potential economic fallout from the trade war, particularly the rise in inflation and the slowdown in US economic growth.

A sharp decline in business activity in the US is expected, especially given the US economy’s heavy reliance on affordable imports from China. The additional tariffs will inevitably increase the cost of doing business for US importers, leading to higher prices for American consumers and a potential slowdown in consumer spending.

As a result of these concerns, traders have begun to shift their expectations for the Federal Reserve’s future actions. The CME FedWatch tool, which gauges market expectations for Fed interest rate decisions, shows a sharp rise in the probability of a rate cut at the Fed’s May meeting. The likelihood of a Fed rate cut has surged to 52.5%, up significantly from just 10.6% a week ago.

Market Outlook for the USD/CAD Pair

Looking ahead, the USD/CAD pair will remain highly sensitive to the evolving trade dynamics between the US and China. As tensions between the two countries continue to rise, the US Dollar could face further weakness, particularly if US economic data continues to reflect the negative impact of higher tariffs and trade uncertainty.

The US Federal Reserve’s actions will also play a crucial role in shaping the future direction of the USD/CAD. If the Fed opts to cut interest rates in May, as the market is increasingly anticipating, the US Dollar could come under additional pressure.

Conversely, if the Fed maintains its current policy stance, the US Dollar may find some support, although the impact of the trade war could still weigh on the currency.

For the Canadian Dollar, the 25% counter-tariffs are likely to keep CAD volatility high, particularly as the Canadian government insists that these measures will remain in place until the US lifts its tariffs. The Canadian economy is also highly dependent on trade relations with the US, and any further escalation in the trade war could have a negative impact on the Loonie.

Conclusion

The USD/CAD pair’s sharp decline below 1.4200 reflects the growing uncertainty in global markets amid the US-China trade war. The US Dollar has come under significant pressure as recession fears intensify, while the Canadian Dollar faces its challenges with the imposition of counter-tariffs. As the situation develops, traders will be closely monitoring both economic data and central bank policies to gauge the future direction of the USD/CAD pair.

COMTEX_465026309/2922/2025-04-29T04:23:47